(Bloomberg) — The Biden administration is refining rules aimed at keeping advanced chips and manufacturing gear out of China, seeking to close loopholes that might help its geopolitical rival gain cutting-edge technologies.

The latest regulations are an attempt to streamline export curbs announced last October, according to people familiar with the matter. The new rules will strengthen controls on selling graphics chips for artificial intelligence applications and advanced chipmaking equipment to Chinese firms, said the people, who asked not to be identified because the information isn’t yet public.

The move will set new guidelines for companies like Nvidia, which has been selling a weakened version of its flagship processor to Chinese companies to abide by the current rules. The tighter standards may make those kinds of workarounds more difficult for American exporters.

The US unveiled the original chip restrictions a year ago in an aggressive attempt to curtail China’s technological development, a step the Biden administration argued is necessary for national security. China has bristled at the restrictions and accelerated investments in building its own domestic capabilities.

As part of the new rules, the US will impose additional checks on Chinese firms attempting to evade export restrictions by routing shipments through other nations. It also will add Chinese chip design firms to a trade restriction list, requiring overseas manufacturers to gain a US license to fill orders from those companies.

The updated restrictions will be published early this week, people familiar with the deliberations said. A spokesman for the National Security Council declined to comment, as did a spokeswoman for the Commerce Department’s Bureau of Industry and Security.

Chinese Foreign Ministry spokeswoman Mao Ning said Monday at a regular press briefing in Beijing that her nation opposed “the US politicizing, instrumentalizing and weaponizing trade and tech issues.”

She added: “We will continue to monitor the developments, and firmly safeguard our rights and interests.”

Chip-related stocks fell in Asia after Bloomberg’s report on the latest restrictions. In Japan, Tokyo Electron, Advantest Corp. and Disco Corp. all retreated at least 1.7%, while South Korean stocks such as Hana Micron Inc. also slid.

Shares of Nvidia, meanwhile, fell in early US trading before rebounding. The stock was up less than 1% at $458.05 as of 2:01 p.m. in New York.

The Biden administration has drawn criticism because of perceived shortcomings in the original export controls. The US unveiled those restrictions before getting the support of key allies, notably the Netherlands and Japan, which allowed chip equipment companies in those countries to continue selling advanced gear to Chinese customers.

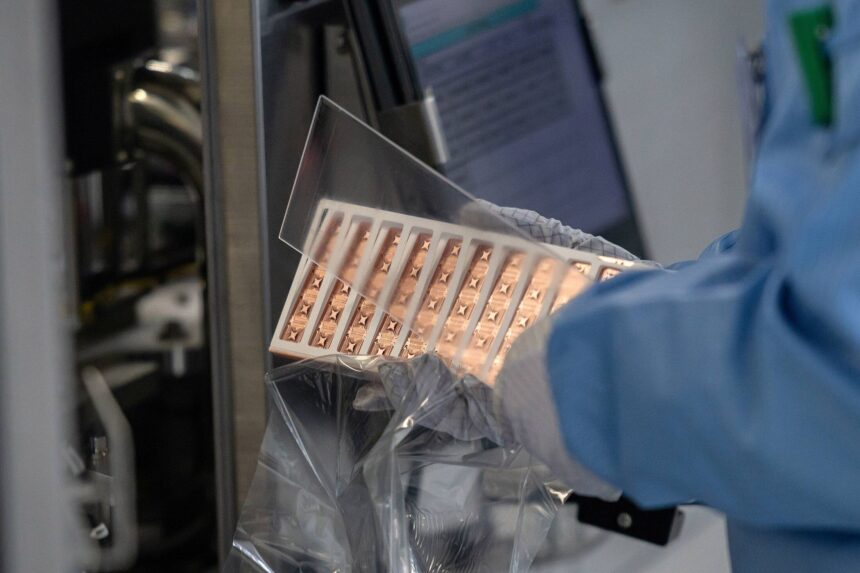

That helped facilitate China’s progress in developing its domestic tech capabilities. Huawei Technologies Co., a Chinese telecommunications giant at the heart of US-China tensions, quietly introduced a new smartphone in August powered by an advanced, 7-nanometer processor. A teardown of the phone revealed the chip was produced by a Chinese company, demonstrating manufacturing capabilities well beyond where the US had sought to stop its advance.

The achievement cast doubt on Washington’s ability to thwart Beijing’s technological ambitions, and spurred political pressure for the Biden administration to impose more sanctions on Huawei and its chipmaking partner, Semiconductor Manufacturing International Corp. The US has begun a formal investigation into the Huawei phone. Any resulting restrictions on Huawei or SMIC would be a separate process from the new export control rules.

“While the Huawei phone is not itself a major national security issue for the United States, what the chip inside signals about the state of the Chinese semiconductor industry absolutely is,” Gregory Allen, director of the Wadhwani Center for AI and Advanced Technologies at the Center for Strategic and International Studies, wrote in a report this month. “These advanced chip production capabilities will inevitably be made available to the Chinese military if they have not been already. Thus, the Huawei and SMIC breakthrough raises many tough questions about the efficacy of the current US approach.”

The new Huawei phone is expected to weigh on sales of Apple Inc.’s new iPhone 15 in the coming months. Already, the Apple device has been off to a slow start in China, according to recent estimates. Sales of the product were down 4.5% compared with the iPhone 14 over their first 17 days after release, according to market tracker Counterpoint Research.

Several companies have objected to the Biden administration’s strategy. Peter Wennink, chief executive officer of Dutch chip equipment leader ASML Holding NV, publicly opposed the measures and warned that Chinese companies would develop competing technology. US companies such as Nvidia – the leader in graphics chips used to develop artificial intelligence services – have also questioned the long-term effectiveness of limiting trade.

Nevertheless, the Biden administration is seeking to address several outstanding issues with the tighter rules, particularly the development of AI and the shipment of technologies through other countries.

The new controls on graphics chips cover components called accelerators, which are used in data centers to train AI software. The Biden administration is tweaking the parameters which govern the export of those chips to China – a move that comes after Nvidia developed the China-specific model to work around last year’s curbs.

The regulations will also require firms to notify the US government before selling to China any chips that fall slightly below the restricted threshold, with the possibility that companies may need to obtain a license to ship those less advanced models.

In addition, the rules will restrict shipments of certain chips to Chinese companies’ overseas subsidiaries and affiliates, and begin requiring a license to export prohibited technologies to countries that could be used as intermediaries.

At the same time, Washington acquiesced to companies’ calls for fewer blanket restrictions, as industry leaders say they need to sell into the world’s largest chip market. Under the new rules, firms will be allowed to export to China all but the most powerful consumer graphics chips, which are typically used in gamer PCs, and will have to notify the US government before shipping a select few consumer chips at the cutting edge.

Nvidia and rival Advanced Micro Devices Inc. rely on their massive consumer chip sales to fund their research and development of data center technology.

The updated rules will not include restrictions on Chinese companies’ access to US or allied cloud computing services, according to US officials familiar with the rules. The administration will issue a request for comment to better understand possible national security risks associated with this access and options to potentially address them.

The US also extended waivers for South Korea firms Samsung Electronics Co. and SK Hynix Inc., plus Taiwanese chip giant Taiwan Semiconductor Manufacturing Co., to continue shipping some restricted chipmaking technology to their facilities in China.