A brand new report from CBRE reveals that ongoing energy shortages are creating alternatives for improvement in rising world information middle markets and driving up rents in established markets worldwide. Corporations aiming to safe information middle capability are more and more investing in rising markets like Northern Indiana, Boise (Idaho), Mumbai (India), Rio de Janeiro (Brazil), and Oslo (Norway), that are experiencing a surge in demand for hyperscale improvement. CBRE anticipates that the provision of energy and land assets in these areas will proceed to draw funding and promote development sooner or later.

“International energy shortages are driving an unprecedented surge in information middle rental charges, significantly in North America, whereas AI developments are having a big affect on information middle demand,” mentioned Pat Lynch, government managing director for CBRE’s Information Heart Options. “Preleasing information middle area effectively prematurely of completion is commonplace throughout the globe, which underscores the strong demand out there and the necessity for ongoing funding in improvement.”

CBRE’s International Information Heart Development Report 2024 examined key variables like complete stock, emptiness charges, web absorption, pricing and rental charges, and availability in each established and rising markets throughout North America, Europe, Asia Pacific, and Latin America.

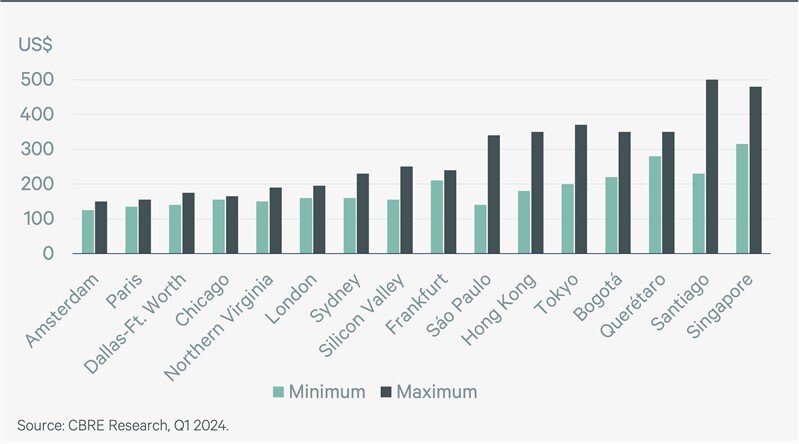

One important development highlighted within the report is the rise in rental charges within the world information middle market. Declining emptiness charges in main markets similar to Northern Virginia, Chicago, Dallas-Ft. Price, Santiago (Chile), London (UK), and Amsterdam (Netherlands) have led to fast will increase in rental charges, with some areas experiencing as much as 50% hikes since Q1 2023.

North America recorded the best world improve, with common asking charges surging by 20% yr over yr. In Chicago, rental charges elevated by 33%, rising to $155-$165 per kW/month in Q1 2024 from $115-$125 per kW/month in Q1 2023.

On a world scale, Singapore has one of many highest rental charges, exceeding $330 per kW/month. In Santiago, charges are as excessive as $500 per kW/month.

The expansion of synthetic intelligence is driving report ranges of knowledge middle demand and rising the necessity for revolutionary information middle designs and applied sciences. This development is resulting in new developments or conversions of unused industrial areas.

“Sourcing energy is the highest precedence for information middle operators throughout the globe,” mentioned Gordon Dolven, director of CBRE Americas Information Heart Analysis. “Markets with accessible, cost-effective energy have gotten hotspots for information middle enlargement. Nonetheless, the expansion we’re witnessing in established markets like Northern Virginia regardless of energy provide constraints is spectacular.”

Information middle stock is steadily rising in markets the place native governments are incorporating renewable vitality into the grid or utility corporations are enhancing transmission strains. As an example, stock in Paris (France) grew by 40.6% from Q1 2023 to Q1 2024, whereas Chicago noticed a 57.2% improve, the biggest in any North American market.

In Dallas, stock rose by 31.9% from Q1 2023 to Q1 2024, reaching 573 MW, solidifying its place because the second-largest North American market. Notably, Dallas is experiencing record-high preleasing and building ranges, with 372 MW presently beneath building and 91.8% already preleased. Globally, markets like Frankfurt (Germany), Mumbai (India), and Oslo (Norway) are additionally witnessing important building exercise.

Regardless of this new improvement, emptiness charges have declined as robust demand continues to outpace provide development. This development is especially evident in Northern Virginia, the place emptiness charges fell to 0.1% in Q1 2024 from 1.8% a yr earlier, the bottom in any North American market, whilst stock grew by 21%. In Amsterdam, emptiness dropped to 11.5% in Q1 2024 from 19.4% a yr earlier.