There are various alternatives for buyers in relation to synthetic intelligence (AI). Breakthroughs in accelerated computing and high-performance semiconductor chips are impacting numerous services.

Within the background, knowledge facilities are one of many extra profitable alternatives benefiting from the rising demand for AI. Whereas Nvidia If the 800-pound gorilla is in knowledge middle providers, sensible buyers perceive that there are numerous corporations competing alongside the chip large.

One factor which will come as a shock is that not all knowledge middle funding prospects are conventional infrastructure and storage tasks. In reality, one in all Nvidia’s “Magnificent Seven” friends is getting in on the motion.

though Amazon (NASDAQ: AMZN) is finest identified for its e-commerce market and cloud computing platform, however the firm not too long ago introduced that it plans an $11 billion funding to construct knowledge facilities in Indiana.

Let’s check out why Amazon is curious about constructing its personal knowledge middle infrastructure, and the way these investments can result in sturdy long-term income sooner or later.

It began with Amazon’s $4 billion partnership

Final September, Amazon introduced it was investing $4 billion in an AI start-up known as Anthropic. On the time of the announcement, Amazon invested $1.25 billion in Anthropic – with the extra $2.75 billion coming in late March.

The core of the funding revolves round Amazon Net Providers (AWS), the corporate’s cloud computing platform. Latest years have been difficult for the macroeconomy, as unusually excessive inflation and rising borrowing prices have had vital impacts on each customers and companies. Enterprise software program suppliers weren’t immune to those issues and skilled slowing income development.

One of many key facets of the deal was that Anthropic agreed to coach future generative AI fashions on AWS. Moreover, Anthropic’s fashions are additionally educated on Amazon’s Inferentia and Trainium in-house semiconductor chips.

Whereas these particulars might have appeared delicate on the time, Amazon’s newest transfer proves that the corporate isn’t messing round in relation to constructing an AI large — and Anthropic represents a key pillar in that roadmap.

Now Amazon is doubling down

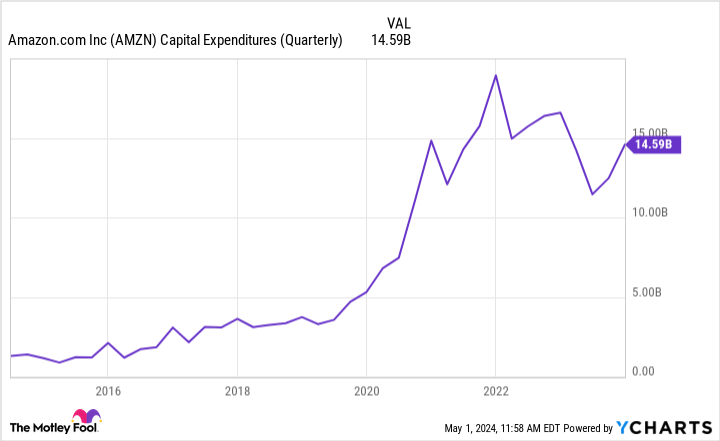

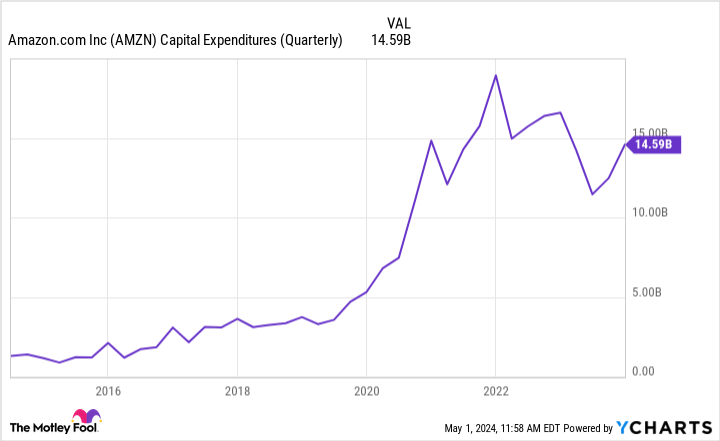

AWS is now a $100 billion run-rate firm. Clearly, as AWS has develop into a extra distinguished a part of Amazon’s development technique, the corporate has invested considerably in cloud infrastructure, evidenced by rising capital expenditures over the previous decade.

These investments don’t appear to be slowing down both. Amazon not too long ago introduced that it plans an $11 billion funding in knowledge facilities in Indiana.

I see the ambitions in knowledge facilities as a mechanism to enrich the Anthropic funding. Amazon is creating its personal customized chips in an effort to maneuver away from an over-reliance on Nvidia’s graphics processing items.

Just like how Amazon perfected warehouse effectivity and delivery logistics by making vital investments in achievement operations, Amazon seems to be emulating this playbook as the corporate makes an attempt to internalize as a lot of its AI roadmap as potential.

I feel these efforts will repay in many alternative methods in the long term. Amazon can broaden its AI capabilities, which ought to unlock new development alternatives for AWS. Furthermore, I believe that constructing our personal knowledge facilities and utilizing inner chips will result in price financial savings in the long run.

Don’t fear, Amazon has a ton of cash

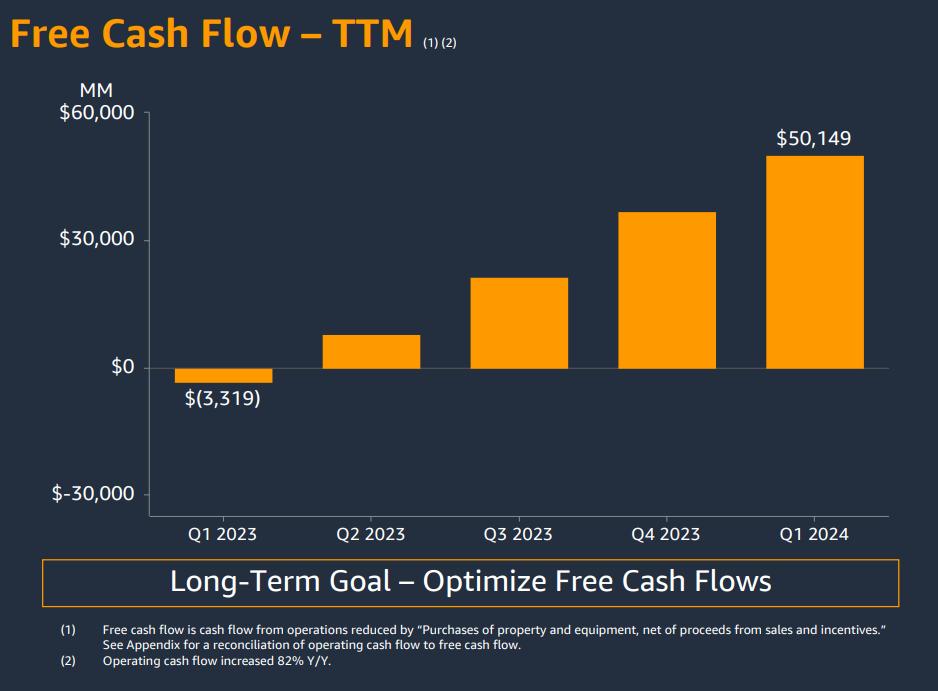

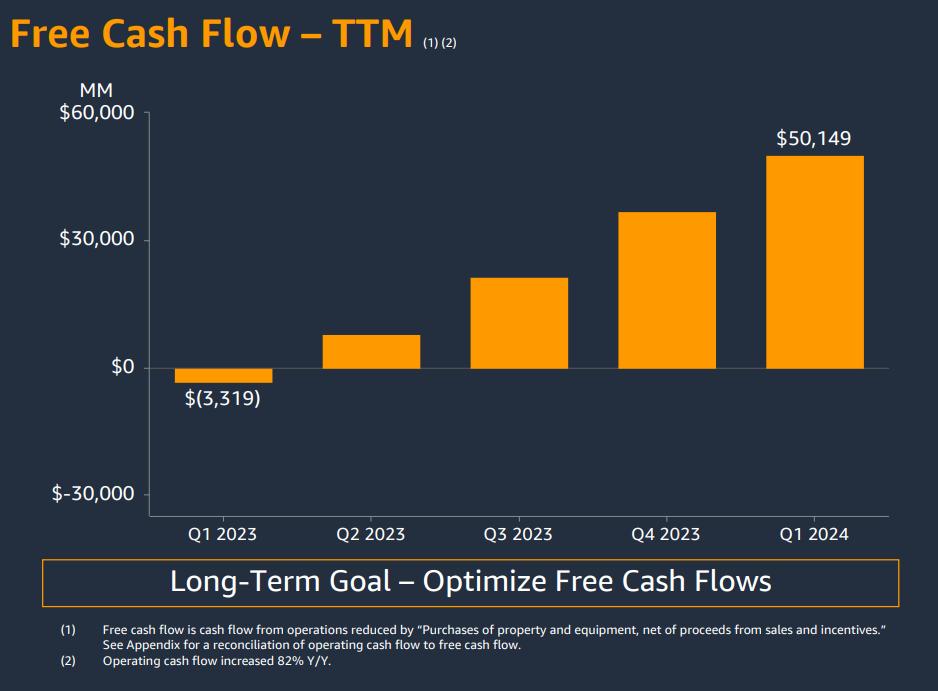

One factor which may trigger some concern is the value tags connected to those lofty AI targets. However don’t fear, Amazon has tons of money.

Throughout the trailing twelve months ended March 31, Amazon generated $50 billion in free money stream. Moreover, the corporate had $84 billion in money and equivalents on its steadiness sheet on the finish of the primary quarter.

Amazon CEO Andy Jassy additionally gave buyers assurances concerning the firm’s deliberate infrastructure investments throughout the firm’s first-quarter earnings name. He claimed:

The extra demand AWS has, the extra we’ve to buy new knowledge facilities, energy and {hardware}. And as a reminder, we spend a lot of the capital upfront. However as you’ve seen over the previous couple of years, we’re offsetting that in working margin and free money stream as demand stabilizes. And we don’t spend the capital with out clear alerts that we will make cash this fashion. We stay very bullish on AWS.

My interpretation of the above remark is that Amazon will seemingly proceed constructing knowledge facilities sooner or later, so long as the demand for AI justifies these investments. Contemplating that Jassy was CEO of AWS for 18 years earlier than taking management of your complete Amazon enterprise, I’m optimistic about his prospects for the corporate’s development in cloud and AI.

I feel the investments in Anthropic, chips and knowledge facilities are extraordinarily sensible and am optimistic that they are going to all assist unleash a brand new part of development for AWS.

Presently, Amazon trades at a price-to-sales ratio (P/S) of three.2. That is primarily flat in comparison with the corporate’s 10-year common price-to-earnings ratio. Traders with a long-term horizon might need to think about choosing up Amazon inventory now, as the corporate’s AI journey is simply starting.

Ought to You Make investments $1,000 in Amazon Now?

Before you purchase inventory in Amazon, think about this:

The Motley Idiot inventory advisor The analyst group has simply recognized what they suppose is the 10 finest shares for buyers to purchase now… and Amazon wasn’t one in all them. The ten shares that survived the minimize might ship monster returns within the coming years.

Take into consideration when Nvidia created this listing on April 15, 2005… when you had $1,000 invested on the time of our advice, you’ll have $544,015!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with portfolio constructing steerage, common analyst updates, and two new inventory picks per 30 days. The Inventory Advisor is on obligation greater than quadrupled the return of the S&P 500 since 2002*.

View the ten shares »

*Inventory Advisor returns Could 6, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions at Amazon and Nvidia. The Motley Idiot has and recommends positions in Amazon and Nvidia. The Motley Idiot has a disclosure coverage.

Neglect Nvidia: this different “Magnificent Seven” member simply poured $11 billion into knowledge facilities. Initially revealed by The Motley Idiot