piranka

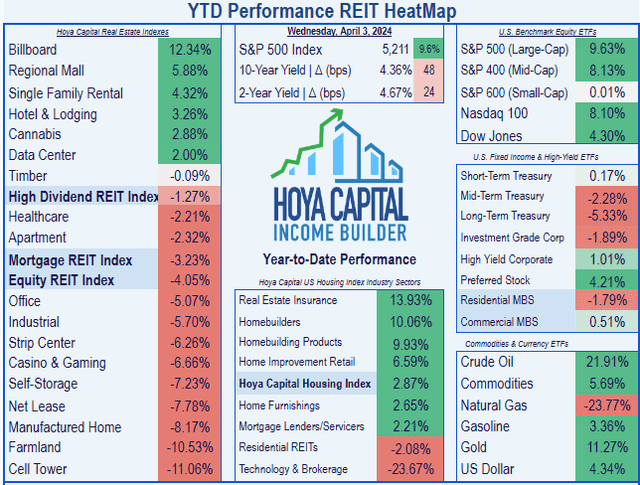

Boosted by the explosion of AI, Information Middle REITs are the sixth-best performing REIT sector up to now this 12 months, with a complete return of two.00%. In contrast, the S&P 500 has returned 9.63% and the Nasdaq 100 has risen 8.10% over the identical interval.

Hoya Capital Earnings Builder

Information Facilities are the REIT sector greatest positioned to learn from the emergence of AI. In naming Information Middle REITs the #1 winner of REIT earnings season, Hoya Capital had this to say:

Information Middle REITs – the bodily hub of Synthetic Intelligence – delivered the strongest returns . . . Pricing energy remained the upside spotlight for knowledge middle REITs as incremental AI-related demand has clashed with a confluence of improvement bottlenecks – energy shortages, greater value of capital, provide chain constraints, ecopolitics, and NIMBYism – to create a extra favorable dynamic and swung the pendulum of pricing energy in direction of current property homeowners.

That enchancment in pricing energy after all means a coming surge in revenues.

For these concerned about beginning or including to their place in Information Middle REITs, this text examines liquidity, income development, measurement, volatility, dividend yield, dividend development, and pricing issues for 4 knowledge middle REITs, to single out the one firm greatest poised to ship outperformance over the subsequent 2 to five years.

What the numbers say

My FROG-hunting strategy to REIT investing depends on simply 7 numbers:

- Liquidity ratio (Property/Liabilities)

- Progress in Funds From Operations (FFO)

- Progress in Whole Money From Operations (TCFO)

- Progress in Dividends

- Market Cap

- Progress in share worth

- Volatility

Hey, what’s a FROG anyway?

FROG stands for Quick Charge of Progress. FROG REITs are vital, as a result of they normally outperform the market in whole return (Acquire + Yield). The factors for figuring out a FROG are as follows:

- Constructive worth acquire over the previous 3 years

- Liquidity Ratio >= 1.66 (ideally >=2.00)

- FFO and TCFO Progress price >= 10% (ideally >=20%)

- Market cap of no less than $1.4 billion.

- Modeled Return better than the return posted by the Vanguard Actual Property ETF (VNQ) over the previous 3 years.

Modeled Return is my very own Rube Goldberg invention that mixes worth acquire, dividend yield, dividend development price, and volatility to reach at one quantity, for comparability to VNQ.

The alternative of a FROG is a COW (Money Solely Needed), which is an organization notable for its prodigious stream of money dividends and plodding or mediocre income development.

How do the candidates stack up?

The candidates are as follows, so as by market cap:

- Equinix (EQIX)

- Digital Realty (DLR)

- Iron Mountain (IRM)

- DigitalBridge (DBRG)

Observe that IRM is included on this evaluation, as a result of it has efficiently grown its knowledge middle section right into a viable participant by cross-selling to its legacy enterprise storage prospects. (American Tower (AMT) additionally has a large knowledge middle enterprise because it acquired CoreSite, however AMT’s knowledge middle section is dwarfed by its cell tower operations.)

First we display on Liquidity, FFO development price per share, TCFO development price, and Market Cap, utilizing the standards above.

| Ticker | Liquidity | FFO Progress % | TCFO Progress % | Mkt Cap |

| EQIX | 1.62 | 8.16% | 12.72 | $80.3 B |

| DLR | 1.91 | 0.00% | 1.94 | $44.6 B |

| IRM | 1.02 | 9.81% | 3.60 | $23.0 B |

| DBRG | 3.35 | NA | 8.13 | $3.0 B |

Supply: TD Ameritrade and Hoya Capital Earnings Builder

(In all tables on this article, development charges are 4-year CAGR, until in any other case specified. I desire to make use of 3-year CAGR, however this is able to give an excessive amount of weight to the pandemic years of 2020-2021.)

First, we verify for firms with Liquidity Ratio lower than 1.66. This eliminates IRM, with its dismal mark of 1.02, and places EQIX on the bubble. This doesn’t imply these firms aren’t good investments, however we’re searching for the creme de la creme, the one firm probably to outperform within the subsequent 2 to five years.

Subsequent, we verify for FFO development or TCFO development lower than 10.0%. That eliminates DLR, which has precisely zero FFO development since 2019, and DBRG, whose FFO/share was damaging this previous 12 months. EQIX stays on the bubble, with an FFO development price of 8.16%. Not precisely what we’re searching for, however within the ballpark.

Subsequent, we get rid of any firm with a market cap beneath $1.4B. Definitive analysis by Hoya Capital has established that small-cap REITs are swimming upstream, till they attain $1.4B in market cap. All 4 firms go this display.

Hoya Capital’s analysis additionally signifies there’s a market cap candy spot. Firms with market cap between $4B-$10B are likely to outperform each smaller REITs and bigger REITs. None of our candidates fall into the candy spot.

Spherical 2: Modeled Return

We’re already right down to only one contender. The opposite candidates have all failed dismally on a number of of the screens. The final FROG criterion is Modeled Return. Listed below are the components and the outcome:

| Ticker | Worth Acquire | Div. Yield | Div. Progress | Div. Rating | Volatility | Modeled Return |

| EQIX | -0.16 | 2.16 | 10.16 | 2.89 | 26.4 | 2.71 |

| VNQ | -3.66 | 4.08 | (-0.23) | 4.05 | 18.4 | 0.42 |

Supply: Hoya Capital Earnings Builder, MarketWatch.com, and creator calculations

Observe: Modeled Return shouldn’t be an try and predict whole return for the approaching 12 months, however relatively a measuring persist with establish firms that can outperform. The broader the margin by which an organization’s Modeled Return exceeds that of the VNQ, the higher its possibilities of outperforming within the coming 12 months.

The Modeled Return for EQIX is an uninspiring 2.71, nevertheless it does exceed the VNQ’s anemic mark of 0.42, so EQIX passes this display.

Do not cease fascinated about tomorrow.

Thus far, our development metrics have been backward-looking. Now we kind our candidates by projected FFO development for 2024. These analyst consensus figures (a.okay.a. educated guesses) are primarily based totally on firm steerage.

| Ticker | FFO ’23 | FFO ’24 * | % incr. |

| EQIX | $31.22 | $34.34 | 10.0% |

| DLR | $6.66 | $7.11 | 6.8% |

| IRM | $3.33 | $3.64 | 9.3% |

| DBRG | (-$0.08) | (-$0.07) | NA |

Supply: Hoya Capital Earnings Builder

* analyst consensus guesstimate

Except for DBRG, all Information Middle REITs are anticipated to develop at a wholesome clip in 2024, however EQIX is the chief of the pack on this metric too.

As a development proposition, EQIX is head and shoulders above the opposite Information Middle REITS, however it isn’t a real FROG, as a result of its Liquidity and FFO development price fall a hair quick.

What now, brown COW?

As I’ve identified quite a lot of occasions, there are primarily two approaches to REIT investing. One is to hunt FROGs, which is my favourite approach. Nevertheless, throughout occasions of rising rates of interest or inflation, or at occasions when yields are comparatively excessive, herding COWs (Money Solely Needed) makes lots of sense.

COWs are comparatively slow-growing REITs that produce prodigious and reliable quantities of milk (dividend money stream on this analogy). Because of the relentless sell-off from November 2021 to October 2023, REIT yields are fairly a bit greater than ordinary proper now, and excessive, protected yield alternatives abound.

Let’s take a look at these firms from a COWhand’s perspective.

Spherical ’em up!

I will begin by rounding up all of the Information Middle REITs that handed the Liquidity display. Any REIT with stability sheet weak spot will are likely to underperform in surprising downturns, so it will get culled out of the herd.

Subsequent we are going to display them for dividend rating and dividend security. Dividend rating initiatives the Yield three years from now, assuming the dividend development price stays unchanged. With a view to right for the consequences of the pandemic, I calculate the 4-year dividend development price, by evaluating whole common dividends for 2019 with the identical determine for 2023.

Listed below are the survivors, ranked by Dividend Rating.

| Ticker | Yield | 2019 Div. | 2023 Div. | Div. Progress % | Div. Rating | Div. Security |

| DLR | 3.47 | 4.32 | 4.88 | 3.09 | 3.80 | D+ |

| IRM | 3.28 | 2.45 | 2.54 | 0.86 | 3.37 | F |

| EQIX | 2.16 | 9.84 | 14.49 | 10.16 | 2.89 | A- |

| VNQ | 4.08 | 3.53 | 3.49 | (-0.23) | 4.05 | C |

Supply: Hoya Capital Earnings Builder, Searching for Alpha Premium, and creator calculations

As you’ll be able to see, all of those REITs not solely pay under the REIT common as represented by the VNQ, however all rating nicely beneath the no-risk return buyers can presently get from treasuries (about 4.5%). In case you are investing for earnings, like a COWhand, why would you put money into any threat asset that pays much less than the no-risk price?

Thus, none of those firms make sense as a worth or earnings play. Investing in a Information Middle REIT presently is strictly a buy-low-sell-high proposition, and income development pushed by pricing energy is the important thing issue.

Might I’ve the envelope, please?

It’s actually no contest. Though it doesn’t fairly qualify as a FROG this 12 months, the perfect Information Middle REIT for the subsequent 2 – 5 years is . . .

Equinix

Hoya Capital Earnings Builder charges EQIX a Purchase. In a current message to members, the service had this to say:

EQIX has dipped . . . over the previous two weeks following the introduced “semi-retirement” of its CEO, who will transition to Government Chairman, and a subsequent unrelated quick report from Hindenburg Analysis. . . we don’t discover the quick report significantly compelling – particularly among the extra vital claims of accounting points – however the observe did successfully compile quite a lot of recognized threat elements. Hindenburg has a poor monitor file on its current REIT shorts, alleging in December 2022 that senior housing REIT Welltower (WELL) was a “shell sport.” After an preliminary dip, Welltower has been one of many top-performing REITs since that report. After all, knowledge middle REITs had been infamously focused by Chanos & Firm in July 2022, a report that successfully got here on the “backside” of a half-decade-long stoop in knowledge middle fundamentals. Information Middle REITs have been the only top-performing property sector since that decision.

Refinitiv and CFRA each price EQIX an Outperform, and Argus charges it a Purchase, whereas Zack’s charges it a Maintain.

As at all times, nonetheless, the opinion that issues most is yours.