(Bloomberg) — Malaysia’s palm oil giants, long-blamed for razing rainforests, fueling poisonous haze and driving orangutans to the brink of extinction, are recasting themselves as unlikely champions in a unique, doubtlessly greener race: the hunt to lure the world’s AI knowledge facilities to the Southeast Asian nation.

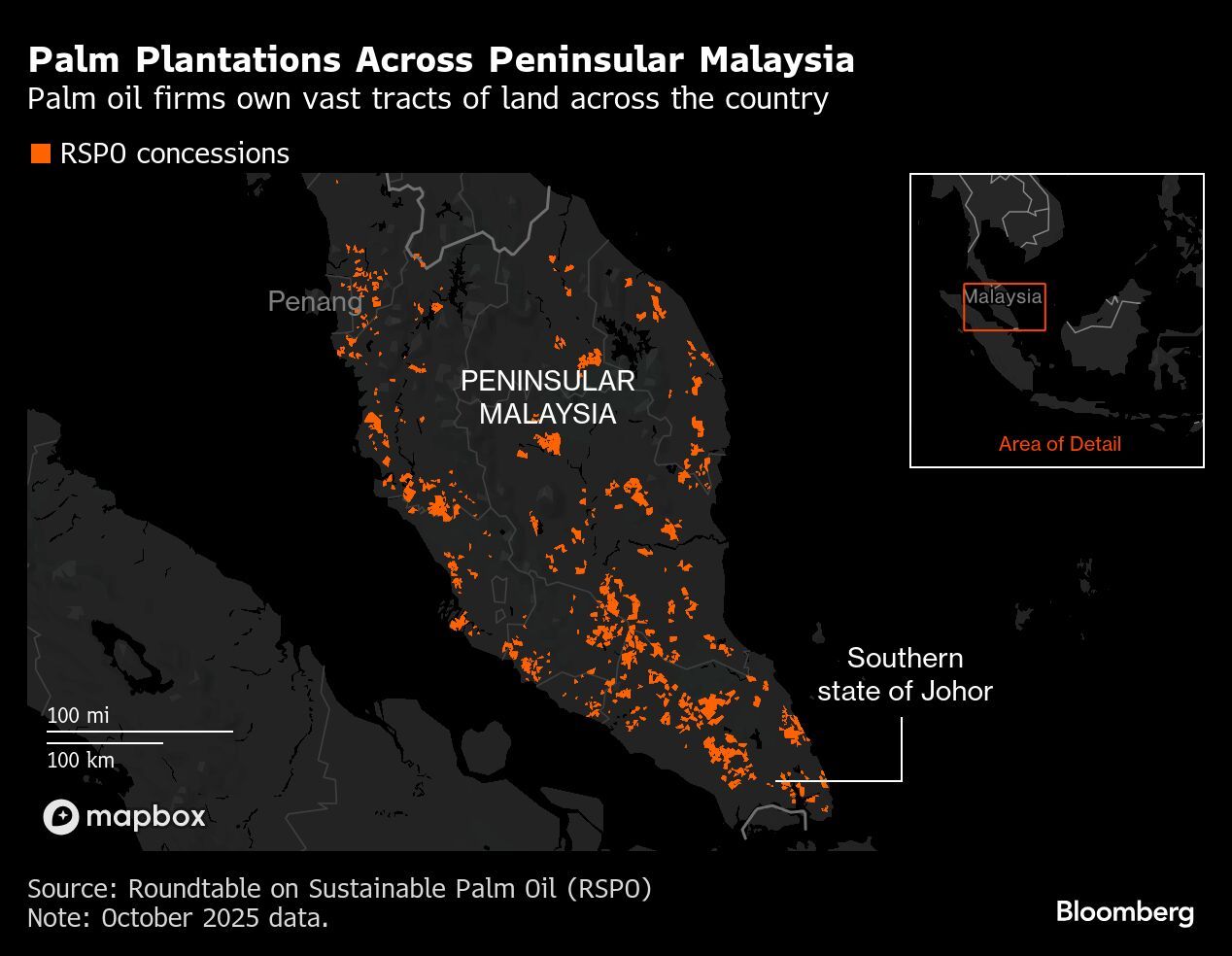

Palm oil corporations are earmarking a number of the huge tracts of land they personal for industrial parks studded with knowledge facilities and photo voltaic panels, the latter meant to feed the insatiable power appetites of the previous. The logic is easy: knowledge facilities are energy and land hogs. By 2035, they may demand a minimum of 5 gigawatts of electrical energy in Malaysia – nearly 20% of the nation’s present technology capability and roughly sufficient to energy a serious metropolis like Miami. Malaysia additionally wants house to home server farms, and palm oil giants management extra land than some other non-public entity within the nation.

The nation has been on the coronary heart of a regional knowledge middle increase. Final 12 months, it was the fastest-growing knowledge middle market within the Asia-Pacific area, and roughly 40% of all deliberate capability in Southeast Asia is now slated for Malaysia, in accordance with trade guide DC Byte. Over the previous 4 years, $34 billion in knowledge middle investments has poured into the nation – Alphabet Inc.’s Google dedicated $2 billion, Microsoft Corp. introduced a $2.2 billion funding, and Amazon.com Inc. is spending $6.2 billion, to call a couple of. The government aims for 81 knowledge facilities by 2035.

The push is partly a spillover from Singapore, the place a years-long moratorium on new facilities compelled operators to look north. Johor, simply throughout the causeway, is now a hive of building cranes and server farms – together with for companies reminiscent of Singapore Telecommunications Ltd., Nvidia Corp. and ByteDance Ltd. However delivering on authorities guarantees of renewable energy is proving tougher.

Photo voltaic panels beside electrical substation at an SD Guthrie website in Selangor, Malaysia, on Mon., Nov. 10, 2025. (Photographer: Samsul Mentioned/Bloomberg)

The strains are already being felt in Malaysia’s knowledge middle capital. Sedenak Tech Park, one in every of Johor’s flagship websites, is telling potential tenants they’ll want to attend till the fourth quarter of 2026 for promised water and energy hookups underneath its second-phase enlargement, in accordance with DC Byte. The emptiness fee in Johor’s dwell services is simply 1.1%, in accordance with actual property guide Knight Frank. Regardless of its speedy progress, the market is nowhere close to saturation, with six gigawatts of capability anticipated to be constructed out over time, stated Knight Frank’s head of knowledge facilities for Asia Pacific, Fred Fitzalan Howard.

That potential bottleneck has incentivized palm oil majors reminiscent of SD Guthrie Bhd. to pitch themselves as each landowners and green-power suppliers.

“That is the place we are able to play a vital, vital function on this ecosystem,” stated Mohamad Helmy Othman Basha, group managing director of the $8.9 billion palm oil producer SD Guthrie. It’s the world’s largest palm oil planter by acreage, with greater than 340,000 hectares underneath its management in Malaysia.

SD Guthrie is pivoting to photo voltaic farms and industrial parks, betting that tech giants hungry for server house will desire websites with prepared entry to renewable power. The corporate has reserved 10,000 hectares for such initiatives over the subsequent decade, beginning with clearing outdated rubber estates and low-yielding palm plots in areas close to knowledge middle and semiconductor funding hubs.

The corporate’s calculation relies on this: one megawatt of photo voltaic requires about 1.5 hectares. Helmy stated SD Guthrie desires one gigawatt in operation inside three years, sufficient to energy as much as 10 hyperscale knowledge facilities used for AI computing. The brand new enterprise is predicted to make up a few third of its earnings by the top of the last decade.

“Each inch of our land going ahead will generate earnings,” he stated in an interview with Bloomberg Information in Malaysia’s Selangor state.

Rivals are following go well with. Kuala Lumpur Kepong Bhd. (KLK), Malaysia’s second-biggest palm planter, lately launched a 1,500-acre KLK TechPark, with BYD, China’s electrical automotive big, as an anchor tenant. A second park, practically twice that dimension, is deliberate for Johor. The agency confirmed it had acquired curiosity from knowledge middle gamers to arrange complexes within the parks, which might be thought-about based mostly on how a lot worth they’ll create.

IOI Company Bhd., one other palm behemoth, has allotted plantation land in Johor for photo voltaic initiatives, though the corporate stated there aren’t any concrete offers but. “Being a comparatively giant landowner, we’re aiming to determine photo voltaic vegetation of a sure dimension,” or a minimum of 300 megawatts, IOI Chief Government Officer Lee Yeow Chor stated throughout a briefing in early November. The aim is to make use of areas the place palm oil bushes are outdated or want replanting.

KLK controls about 355,000 hectares, primarily throughout Malaysia and Indonesia. IOI has practically 200,000. Along with Guthrie, the trio dominates Malaysia’s land financial institution.

“It’s a novel alternative for palm oil plantations in Malaysia, given the big tracts of land that current scalability for knowledge middle developments,” DC Byte lead analyst Vivian Wong stated.

It could even be extra worthwhile for the palm oil corporations. A Maybank report final 12 months estimated earnings from large-scale photo voltaic operations to be greater than 50 occasions the common revenue from palm oil cultivation. There are already some small success tales within the trade, reminiscent of Gopeng Bhd., a small-time planter that swung from a loss to giving its greatest shareholder return in three years by venturing into renewable power.

Development website of BYD’s plant at KLK TechPark in Perak, Malaysia. KLK, the nation’s second-largest palm oil planter, is planning a second park in Johor. (Photographer: Samsul Mentioned/Bloomberg)

However the brand new enterprise isn’t with out threat. Palm oil companies may find yourself with acres of unused knowledge facilities. “The danger is constructing industrial parks within the mistaken place, as knowledge facilities are extremely location-specific,” stated Fitzalan Howard, who famous main websites want as much as 50 acres – making location errors pricey.

Tropical warmth provides one other problem: knowledge facilities require substantial cooling, which means services in Malaysia will devour roughly 25% extra power than one in a metropolis like London, Fitzalan Howard stated.

Which raises the query: Can corporations that spent a long time as local weather pariahs reinvent themselves as green-energy saviors?

Unlikely, stated Ivy Ng, head of Malaysia analysis and agribusiness at CIMB Securities. Sure, it might scale back their carbon footprint and enhance their environmental, social and governance profiles, however palm oil will stay core to their enterprise, she stated.

As soon as a colonial-era crop, palm oil has grown into a worldwide client staple present in practically half of all grocery store merchandise. To maintain up with rising demand, palm corporations turned to deforestation, notably in Malaysia and Indonesia, the place huge stretches of tropical rainforest have been cleared to make means for plantations. Within the Malaysian a part of Borneo, as a lot as 60% of the rainforest was destroyed between 1973 and 2015, resulting in habitat loss and emissions. Producers now face mounting stress to undertake sustainable practices.

“It’s a transfer in the appropriate course,” Ng stated of palm corporations’ push into inexperienced power. However “it’s too small to make a really large distinction to the corporate’s general future prospects.”

Environmental teams are skeptical, calling photo voltaic ventures a bid to monetize ageing estates quite than reform core practices.

“Whereas these ventures could assist enhance an organization’s ESG standing on paper, true credibility and sustainability depend upon addressing core points inside their palm oil operations — reminiscent of deforestation, peatland degradation, labor rights, and provide chain transparency,” Greenpeace Malaysia stated. “Merely including ‘inexperienced initiatives’ on the facet is not sufficient, as traders and markets are more and more discerning and might distinguish real transition efforts from greenwashing.”

As for SD Guthrie’s Helmy, who might be stepping down from his place on the finish of this 12 months, he’s nonetheless hopeful that this new enterprise will rework the notion of palm oil, which has been focused by boycotts within the West.

“Palm oil has been demonized for the longest time,” Helmy stated. “Now it could actually play a job in renewable power.”