Jones Lang LaSalle JLL — popularly generally known as JLL — just lately introduced that it has entered into an settlement to amass a New York-based supplier of information heart technical and venture administration companies, SKAE Energy Options (”SKAE”). The deal is predicted to shut quickly, topic to customary closing circumstances.

This transfer will enable Jones Lang to supply options all through your complete knowledge heart lifecycle and add important technical depth to its current choices. SKAE’s experience will improve JLL’s capacity to help purchasers with essential knowledge heart website choice, design, testing and commissioning, upgrades and operations administration.

Per Neil Murray, CEO of Work Dynamics, Jones Lang, “With the continued progress of the worldwide knowledge heart market, we’re seeing elevated alternative to ship the specialised experience required to handle and preserve these property. This acquisition instantly enhances our capacity to expertly help our purchasers’ knowledge heart options now, and into the longer term.”

The acquisition appears a strategic match, with JLL’s latest International Information Heart Outlook highlighting how AI and machine studying are driving a shift in knowledge heart design, website choice and funding method.

There’ll possible be a big surge in knowledge technology by each shoppers and companies over the following 5 years. This surge is predicted to be twice the quantity of information created up to now decade. Consequently, the storage capability of information facilities is projected to extend from 10.1 zettabytes (ZB) in 2023 to an estimated 21 ZB by 2027.

Following the deal’s completion, SKAE’s 75 staff will turn into a part of JLL Work Dynamics. The acquisition will kind JLL’s Technical Companies division inside the Information Heart vertical and can proceed to function as SKAE, a JLL firm.

Over the previous years, Jones Lang has undertaken a number of strategic acquisitions as a part of its world progress technique, thereby increasing its capabilities in a number of service choices. The corporate continues to search for alternatives to put money into its enterprise, each organically and thru mergers and acquisitions.

Jones Lang’s superior consumer companies and strategic funding in know-how and innovation are anticipated to assist develop market share and win relationships. The truth is, strategic investments made on the know-how entrance helped it to properly navigate the difficult instances.

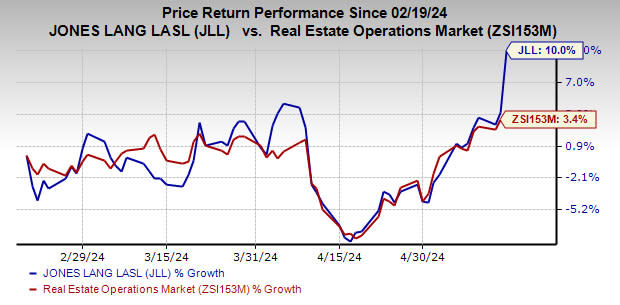

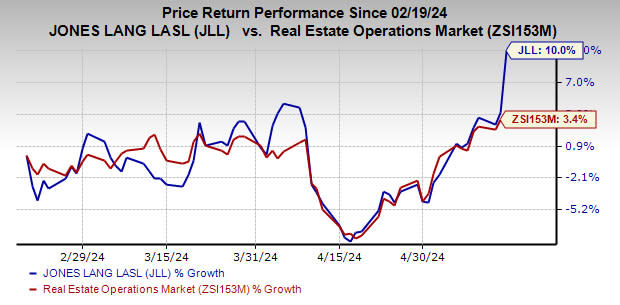

Over the previous three months, shares of this Zacks Rank #3 (Maintain) firm have rallied 10% in contrast with the trade’s upside of three.4%.

Picture Supply: Zacks Funding Analysis

Shares to Think about

Some better-ranked shares from the broader actual property trade are Inexperienced Brick Companions GRBK and Kennedy-Wilson KW, every sporting a Zacks Rank #1 (Robust Purchase) at current. You’ll be able to see the entire checklist of right now’s Zacks #1 Rank shares right here.

The Zacks Consensus Estimate for GRBK’s 2024 earnings per share has been raised 10.2% over the previous month to $7.46.

The Zacks Consensus Estimate for KW’s ongoing yr’s earnings per share has been raised to 1 cent in opposition to unfavourable $1.36 over the previous week.

Need the most recent suggestions from Zacks Funding Analysis? Immediately, you may obtain 7 Greatest Shares for the Subsequent 30 Days. Click to get this free report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

Kennedy-Wilson Holdings Inc. (KW) : Free Stock Analysis Report

Green Brick Partners, Inc. (GRBK) : Free Stock Analysis Report