The “A” in AI stands for “artificial.” But it might also stand for “adrenalin” in the context of how the democratization of artificial intelligence and machine learning is impacting the development, design, and number of data centers globally.

In its 2024 Global Outlook on the Data Center market, the research firm JLL states that this democratization “stands to be the biggest transformation in the data center industry since the sector burst onto the scene.” AI and machine learning are prompting fundamental shifts in data center design, site selection, and investment approaches.

The sector’s growth, however, faces challenges that, most prominently, include regional power limitations that are compelling more developers and investors to search for reliable alternative—and, increasingly, more sustainable—power sources, as well as improved operational efficiencies.

Insatiable data demand requires more power

JLL’s report presents a booming market with insatiable demand. The report cites estimates projecting that consumers and businesses will generate twice as much data over the next five years as all the data created during the previous decade. To meet that demand, total storage capacity will increase to 21 zettabytes in 2027, from 10.1 ZB in 2023.

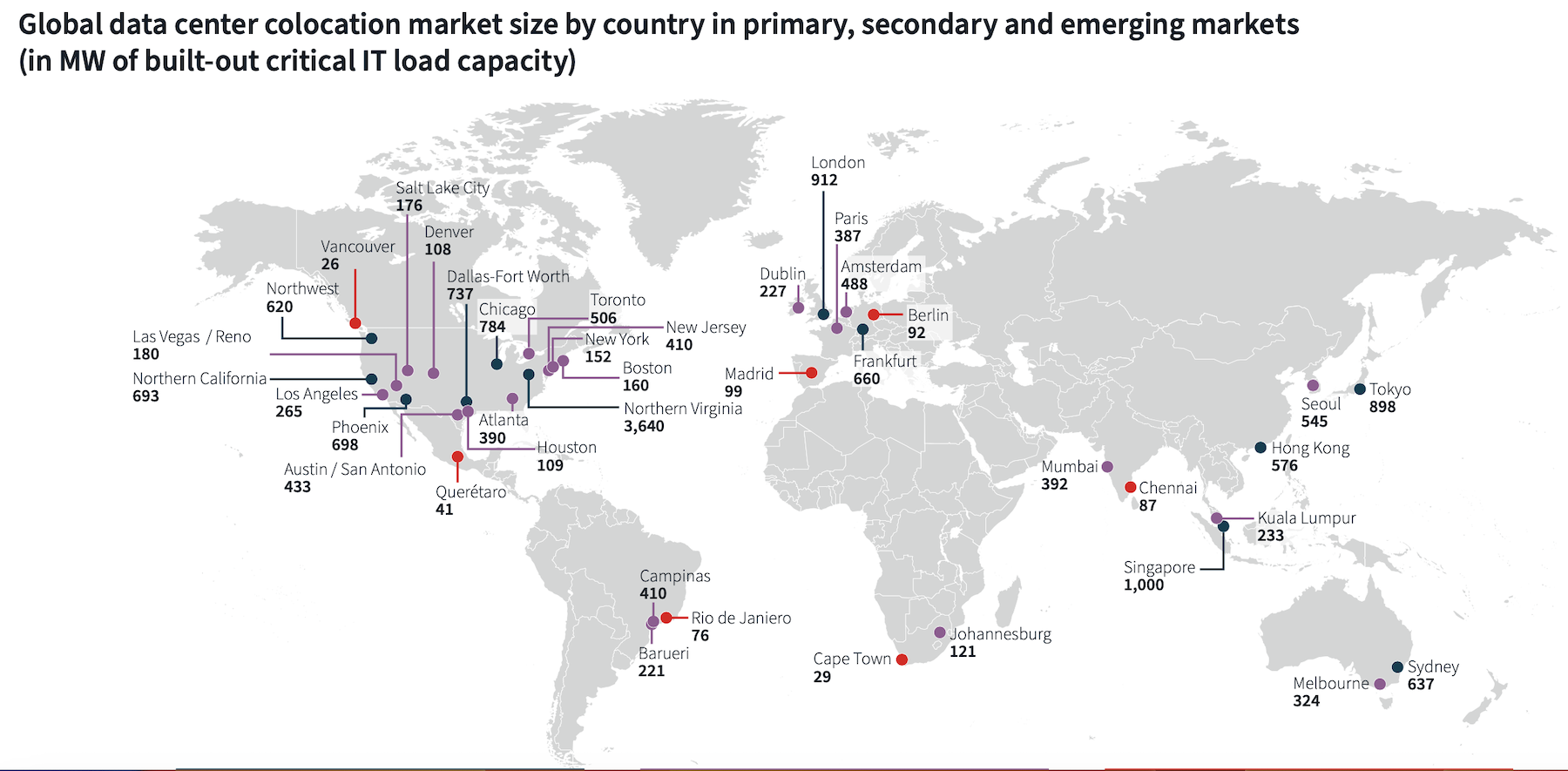

Global colocation megawatts are expected to grow by 15.2% over the next five years, and it is not uncommon for developers to announce new colo construction with 100 MW or more capacities.

Data center growth is manifesting itself in primary markets, some of whose aggregate supplies now exceed 1,000 MW.

This robust sector is already being disrupted by the emergence of generative AI, says JLL. Its report cites Bloomberg Intelligence’s estimate that investment in Gen AI will reach $1.3 trillion over the next five years, from just $40 billion in 2022.

Gen AI requires more densely clustered and performance-intensive IT infrastructure than is found in most data centers, producing more heat. And Gen AI’s power needs fluctuate—image creation needs more power than creating text, for example—making power optimization more difficult to achieve. Future data center development for both large and small facilities will need to take power requirements into greater account.

Seeking operational efficiency

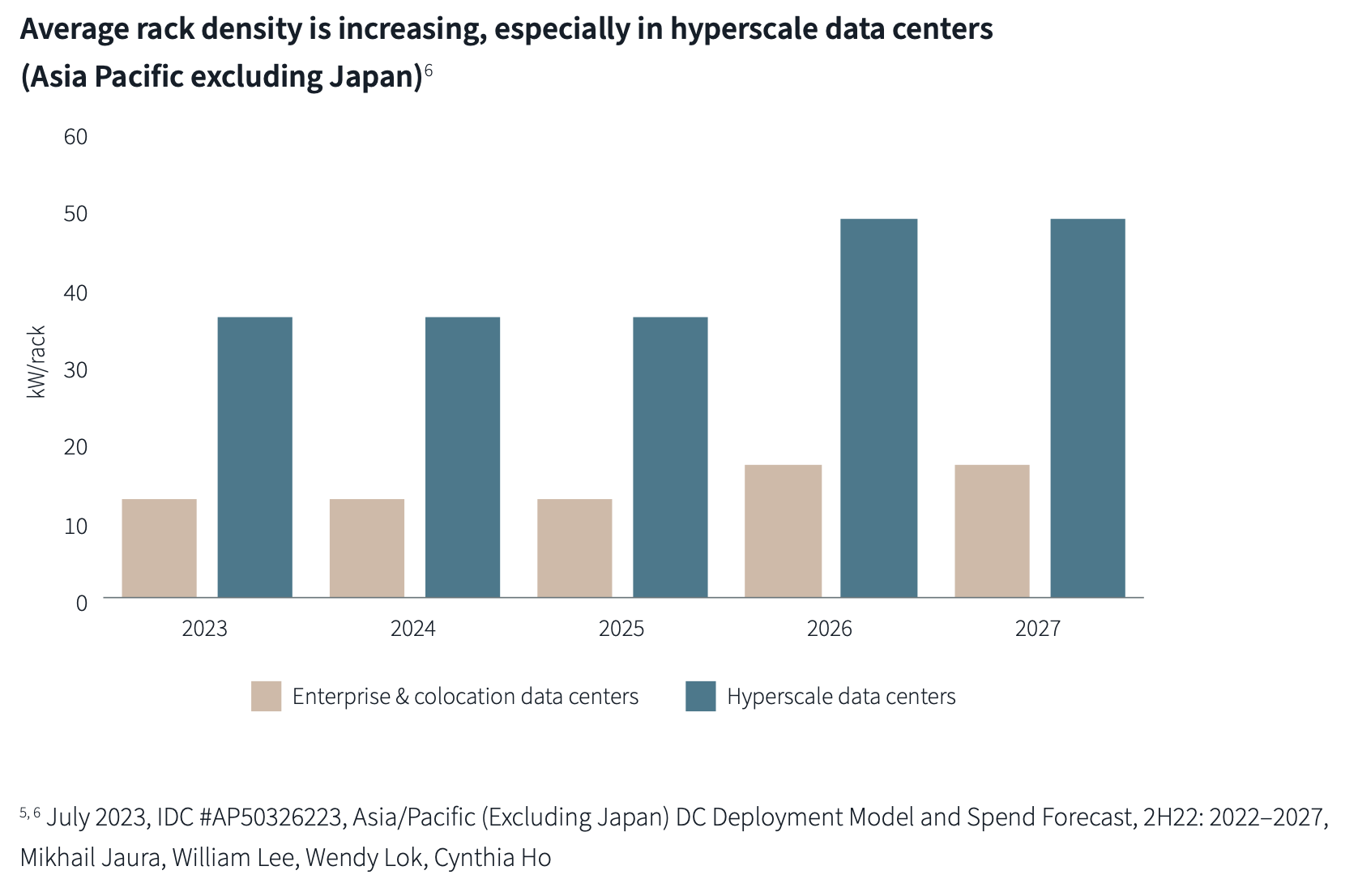

JLL predicts that the rapid adoption of Gen AI will continue to drive data center design and, specifically, rack power density, which has been increasing slowly over the past several years. Larger data centers, whose densities average 36kWs per rack, are expected to climb to an average of around 50 kWs by 2027, with some facilities getting up to between 80 and 100 kWs.

Computational needs and the demand for hyperconverged infrastructure—the combination of servers and storage into a distributed infrastructure platform—are also driving the need for more power density. And as racks become denser, cooling—which accounts for around 40% of the electricity data centers consume—will move into clearer focus.

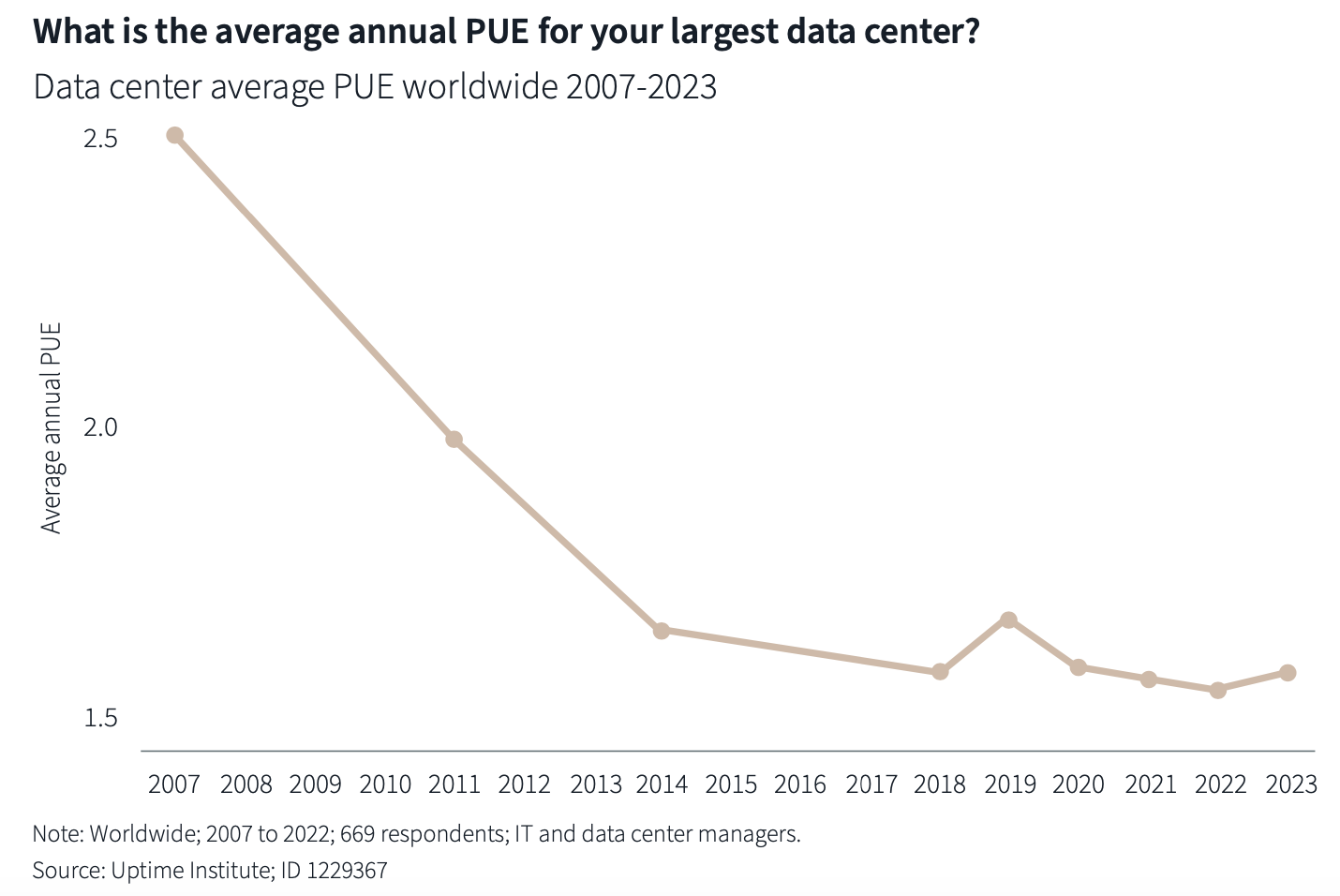

Developers and operators have made strides toward improving data centers’ Power Usage Efficiency (PUE). JLL spots an ongoing shift toward liquid cooling to save energy in high-rack-density environments. Operators are also turning to software for managing their facilities, which includes “software defined power” that optimizes data centers’ energy use.

Using algorithms, operators are gaining efficiency by increasing their data centers’ computational yields from CPU cycles via distributed computing through multiple servers and quantum processing for AI and ML.

Lowering data centers’ carbon emissions

JLL notes that global electricity use by data centers has remained flat since 2015, even as data center workloads have doubled. However, energy demand in smaller markets has been rising lately. And, more generally, power access in many markets is challenged by antiquated electrical grids, and competition for power from advanced manufacturing, electric-vehicle charging, and other big users.

JLL predicts users and developers will increasingly seek out sites for new data centers in secondary and tertiary markets due to extended timelines for power procurement. (The report also points to markets in California and Texas that are already “load shedding” by reducing power during peak demand periods.)

Some developers have been looking to reduce their data centers’ carbon footprints. Data centers and data transmission account for an estimated 1% of energy-related greenhouse gas emissions. Consequently, some developers have been looking into drawing power from more sustainable sources like solar and wind. Others, says JLL, have been exploring onsite power generation from modular nuclear reactors, hydrogen fuel cells, and natural gas. (NuScale’s small modular reactor was the first to receive approval in the U.S. a year ago. Microsoft is also exploring modular reactors as part of its energy strategy.)

JLL’s report includes a case study of Energiewende, Germany’s ambitious effort to phase out nuclear and coal-fired energy sources by increasing its investment in solar and wind power, with a goal of generating 65% of the country’s electricity needs from “clean” sources by 2030.

The report states that hyperscale data center operators are expanding to midsize and smaller markets to find reliable, scalable and low-carbon power sources that include rooftop solar and small reactors with up to 300 MW. Secondary market that offer scalable lower-carbon options include Atlanta, Salt Lake City, Denver, Reno, Columbus, Charlotte, and internationally, Sweden and other Nordic countries.

JLL notes that in recent years, cloud giants have entered into power purchase agreements for low-carbon solutions. Amazon, for one, invested in more than 100 new solar and wind energy projects last year, and now supports 400-plus renewable energy projects in 22 countries.

Data centers’ emphasis on sustainable growth is likely to present opportunities for AEC firms, from redesigning existing facilities to working with developers planning to build specialized data centers for training and tuning AI.