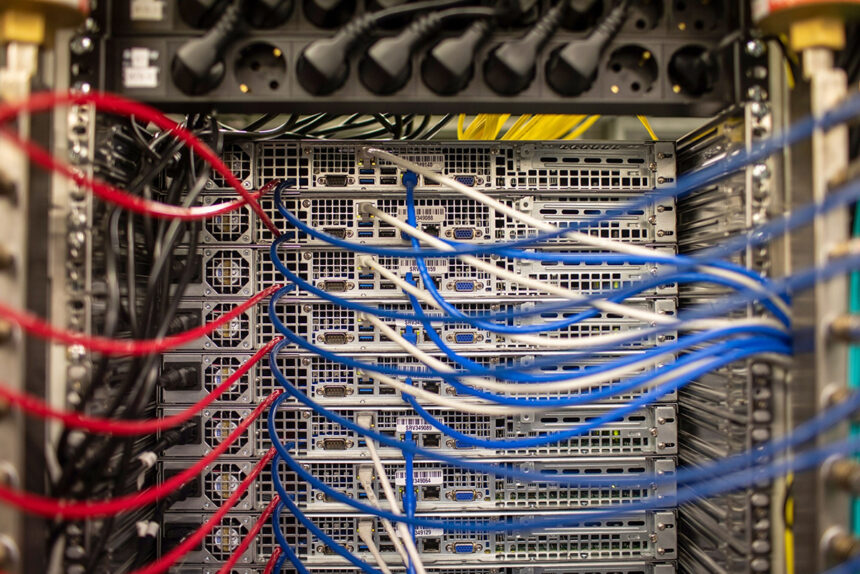

(Bloomberg) — Private equity firm Convergence Partners said it acquired a South African company that manages IT networks and runs data centers, betting that demand for such services will surge on the continent.

The acquisition of Datacentrix is the sixth by the firm in the past year as it accelerates the deployment of its $300 million Africa tech-focused fund, Convergence Chairman Andile Ngcaba said. The purchase is its biggest yet, he said, without disclosing financial details.

“The advent of artificial intelligence, combined with cloud, blockchain, and web3 present the greatest opportunity for Africa,” said Ngcaba. “We are seeing exciting opportunities in those areas, as well as our other investment focus areas including data centers, towers and fintech.”

About 796 million people will enter the workforce in Africa by 2050, according to McKinsey & Company, fueling the need for increased connectivity to conduct banking services and shop online. To service the growing number of young people, the continent needs $100 billion in investments to bridge the digital divide by 2030, according to Ngcaba.

Convergence raised $296 million to buy African technology assets a year ago, with demand for funding of digital assets since then being “vast and many,” said Ngcaba. Convergence has also invested in a vehicle-tracking company C-Track and fintech firm 42Markets, among others, said Ngcaba. It’s acquiring Datacentrix from Alviva Holdings.

The company could list Datacentrix in the medium term, Ngcaba said. The PE firm, which has executives in South Africa, Nigeria, and Mauritius will soon open an office in Kenya, he said.