KE ZHUANG

Funding Thesis

Buyers proceed valuing Constellation Power compared to different utility corporations, with disregard in direction of regulatory benefits and knowledge middle energy demand. Whereas worth appreciation values the corporate at 16x EBITDA and 30x earnings, a lot of its worth nonetheless stays probabilistic. As seen with the Amazon and Talen deal in March, urgency for knowledge middle corporations to safe energy stays at an all-time excessive. In Constellation’s Q1 2024 convention name, administration famous related curiosity from potential clients, almost certainly on a a lot bigger scale. Furthermore, clear vitality initiatives present Constellation with foundational help, particularly because the destructive notion of nuclear shifts in direction of the constructive. Then, the corporate’s ten-year EPS growth guidance of 10% signifies increased ahead energy costs. In gentle of this, I imagine Constellation has much more room to run alongside the event of a long-term funding alternative. My goal worth for CEG is $265.48 based mostly on 2027 EBITDA of $6,275 million and 15x EBITDA.

Firm Profile

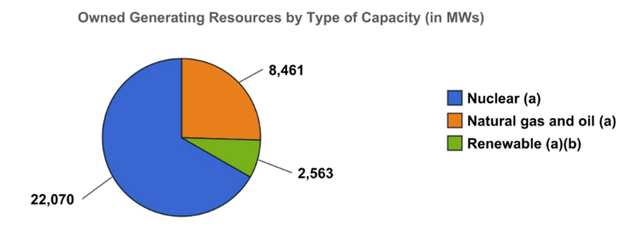

Constellation Power (NASDAQ:CEG), beforehand a part of Exelon Company (EXC), was spun off on February 1, 2022. Presently, CEG is now the most important producer of carbon-free vitality in the US with a diverse portfolio throughout nuclear, wind, photo voltaic, and hydropower technology. Their operations span throughout the US, Canada, and the UK. This consists of roughly 2 million clients, together with 1.7 million residential clients, and 75% of the highest 100 US corporations. Their technology fleet, which is almost 90% carbon-free, positions them because the main participant within the clear vitality transition. CEG goals to deliver this quantity to 95% by 2030 and 100% by 2040. Beneath you may see the breakdown of technology kind, with renewable together with wind, hydroelectric, and photo voltaic producing belongings.

Firm Presentation

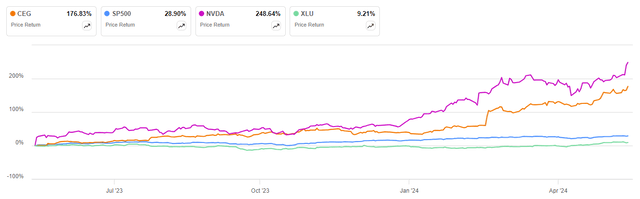

To handle the elephant within the room, Constellation Power’s inventory worth has risen 176.83% over the past yr. For perspective, the S&P 500 (SPX) rose 28.90%, NVIDIA (NVDA) rose 248.64%, and the Utilities Sector (XLU) rose 9.21%. Whereas this may increasingly appear costly, my evaluation under ought to assist you perceive its business positioning and why the market has not totally priced in clear and constant energy demand.

Searching for Alpha

Monetary Overview

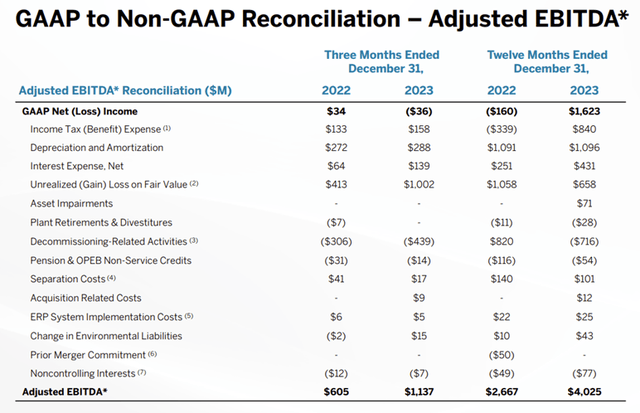

The corporate remains strong financially, producing $2.9 billion in adjusted working earnings on $24.9 billion in income throughout 2023. Whereas income solely grew 2% year-on-year, working earnings greater than doubled from $1.4 billion in 2022. On a GAAP foundation, internet earnings grew from -$160 million in 2022, to $1,623 million in 2023. This favorable increase was pushed by CEG’s means to promote electrical energy at increased costs whereas additionally optimizing energy technology and supply administration. In addition they noticed favorable internet nuclear decommissioning exercise and an unrealized acquire in a public funding. Beneath you may see the GAAP to Non-GAAP Reconciliation.

Firm Presentation

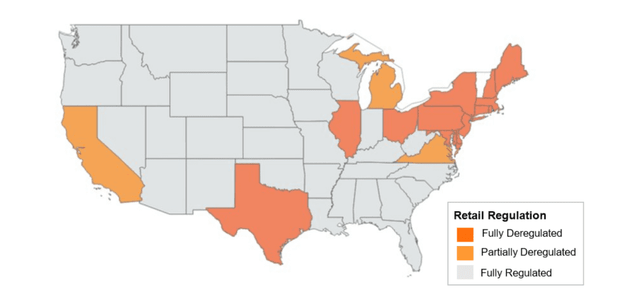

Moreover, Constellation operates as an unbiased energy producer, permitting for a market-based income mannequin. This dynamic is a key purpose they will revenue from elevated knowledge middle demand. Conversely, regulated utilities function beneath a cost-of-service mannequin, the place charges are based mostly on underlying prices plus a predetermined price of return. As seen under, Constellation’s key markets throughout the northeast, Illinois, and Texas enable for extra aggressive go-to-market methods.

Regulated vs. Deregulated Markets (COHO Local weather)

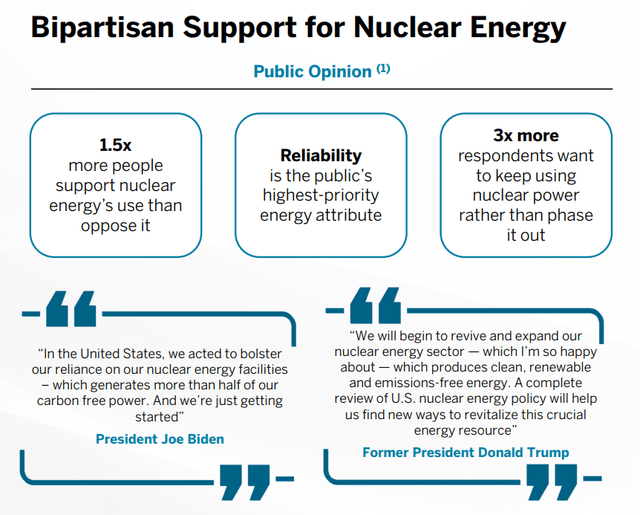

They’re additionally closely reliant on government support to enhance monetary efficiency. This contains Zero Emission Credit (ZEC), a state-level subsidy for clear vitality manufacturing, and Nuclear Manufacturing Tax Credit (PTC), part of the Inflation Discount Act (IRA) that gives tax credit for nuclear vitality manufacturing. Varied different incentives additionally exist to enhance operational effectivity and monetary outcomes. Beneath you may see the bipartisan political shift in direction of nuclear vitality help, implying a lower in destructive connotation, and the potential for additional authorities incentives.

Firm Presentation

Information Middle Energy Demand

The primary driver of Constellation’s worth efficiency is the potential for knowledge middle energy technology offers. Three months in the past, a small firm known as Talen Power entered right into a take care of Amazon (AMZN) AWS to promote its Cumulus knowledge middle for a gross worth of $650 million. The sale grants Amazon the rights to all of the land, energy infrastructure, intangibles, and entry to a provide of nuclear energy from Talen’s Susquehanna energy station. Briefly, the wave of synthetic intelligence has created the necessity for extra knowledge facilities, which require a big quantity of dependable, 24/7 clear vitality.

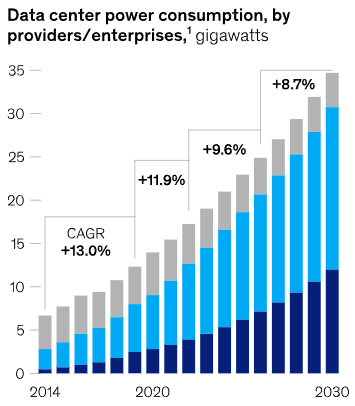

On CEG’s aspect, nothing has totally materialized but, however the potential for a fair bigger deal is extraordinarily profitable. The AWS deal solely contained 960MW of knowledge middle capability, with CEG exploring offers within the 3GW+ vary. Whereas this is able to require a mixture of advanced energy sourcing and infrastructure help, it might additionally result in vital income alternatives. Beneath you may see the potential demand for US knowledge middle energy consumption, a big driver of this thesis. Grey represents enterprises, gentle blue represents co-location corporations, and darkish blue represents hyperscalers.

McKinsey

Negotiation Standing and Feasibility

Constellation administration has additionally highlighted ongoing talks with main hyperscalers which have been conducting onsite due diligence. This contains evaluating website allowing, fiber networks, backup energy, and water accessibility. Timing stays unsure, but when any potential offers happen over the second half of 2024, I might anticipate vital worth appreciation.

By way of energy provide, offers will both include onsite connectivity or digital agreements via the grid. Principally, the info facilities will both be situated shut sufficient to obtain energy straight from the nuclear plant or via a digital PPA (energy buy settlement) to make sure the vitality comes from a CEG nuclear facility. Each of those conditions infer premium pricing to ensure clear and fixed energy technology.

Throughout Constellation’s 12 potential websites and 21 reactors, solely a choose few are thought of possible. This probably consists of Pennsylvania and Illinois, which compromise CEG’s largest operational nuclear footprint. Extra particularly, Pennsylvania presents sturdy regulatory help and has a powerful geographical location to serve giant east coast markets. Whereas Illinois hosts essentially the most Constellation nuclear websites and is already thought of infrastructure prepared. Moreover, a possible reopening may happen for Pennsylvania’s Three Mile Island, offering much more help.

Pricing Energy

Two essential elements enable an organization like Constellation to cost premium costs. Firstly, 24/7 energy technology, and secondly, clear vitality manufacturing. Presently, just one kind of vitality has each these traits, nuclear. Now returning to the Talen Power instance, the ten-year PPA take care of AWS consisted of supplying vitality at $75 to $80 per MWh. This website would’ve operated at round $45 per MWh based mostly on market charges, implying a ~70% worth premium.

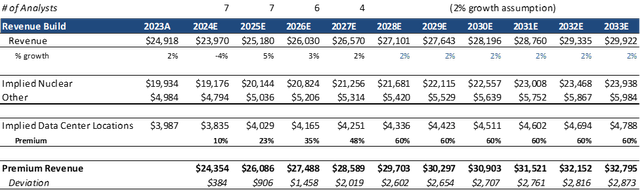

Whereas tough to pinpoint, we all know CEG’s nuclear fleet accounts for 80% of whole income, with Illinois and Pennsylvania accounting for 50%-60% of whole nuclear income. To stay conservative, let’s then assume 20% of this income is taken into account premium and calls for 60% over market pricing. Beneath, I created a tough estimate of this evaluation in comparison with present median analyst income steering.

Writer’s Calculations

This income construct could seem underwhelming, however take into account the conservative nature of the utility business and underlying assumptions. First, let’s acknowledge the extent to which knowledge middle offers are priced in is minimal. Whereas analysts could assume a slight degree of premium pricing, no full-fledged offers have occurred, making these assumptions extra speculative. Then again, if we infer extra bullish assumptions with a 70% worth premium, 40% of nuclear income, and 2027 premium appreciation, we may see potential income of $37.5 billion by 2028. Though this evaluation is extra theoretical, it ought to assist visualize the potential income premium that Constellation Power may demand.

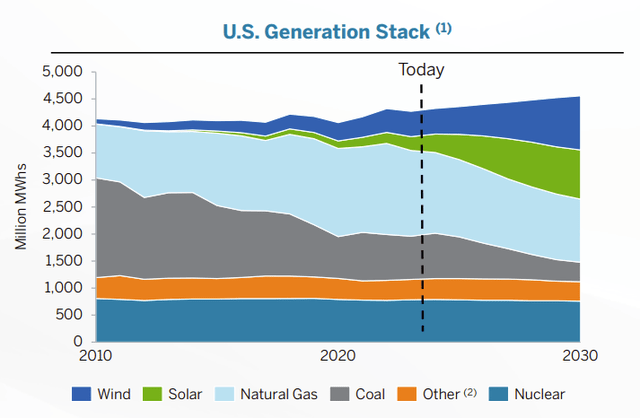

Asset-Backed Basis

Taking a step again, let’s try to grasp the present US electrical energy technology market. The principle supply of vitality stays fossil fuels, with pure gasoline accounting for 43.1% and coal accounting for 16.2%. On the renewables aspect, the entire solely accounts for 21.4%, which consists of wind, hydro, photo voltaic, biomass, and geothermal. Beneath you may see the breakdown, with “Right now” being the top of 2023. Over the past decade, coal has been changed with pure gasoline, and each have solely barely decreased. 2030 forecasts, the EIA believes each wind and photo voltaic will drastically improve, and nuclear will not transfer in any respect. That is the place I imagine the clear vitality narrative falls quick.

EIA

The solar does not all the time shine, and the wind does not all the time blow. This implies renewable vitality is completely reliant on batteries. The issue is, battery innovation has proved difficult. In short, moral and elementary provide issues for lithium and cobalt are rising, compounded by points with decade-old lithium-ion battery expertise. Different approaches embrace solid-state and sodium-ion batteries, however this expertise nonetheless requires vital funding, enchancment, and time.

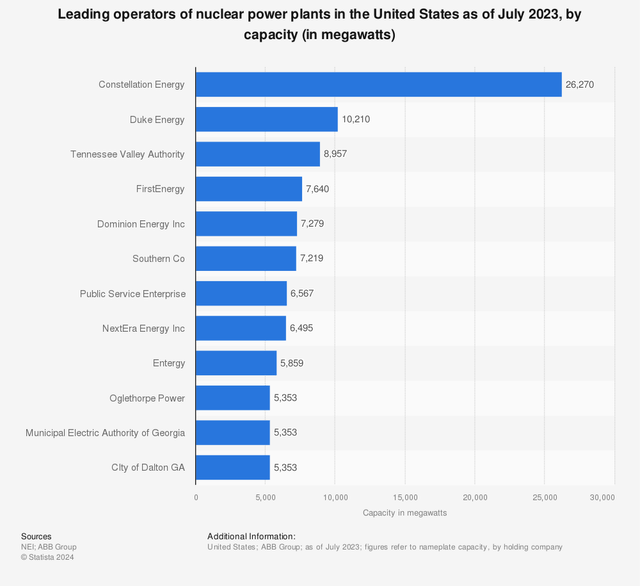

The shift in direction of clear vitality manufacturing, coupled with challenges in storage, factors to at least one conclusion, nuclear. Nonetheless, nuclear development is forecasted to remain flat via 2030. My out of consensus viewpoint solely additional underscores the potential upside. As soon as people notice present environmental targets lack feasibility, nuclear energy will solely obtain extra consideration, which can result in extra funding. This, alongside the premium pricing energy of 24/7 clear vitality technology, creates the proper recipe. Beneath you may see simply how established Constellation Power is to choose up this demand.

Statista

In abstract, I see Constellation’s nuclear management as a catalyst to help underlying political narratives and make the most of capital effectively. Whereas knowledge middle and nuclear technology offers are beginning to see traction, total nuclear development is forecasted to stay flat. I believe this story will start to shift over the approaching years, with the potential reopening of Three Mile Island as the primary catalyst.

Valuation

Transparently, Constellation is a tough firm to worth, and its vital worth appreciation has solely lowered the margin of security. Nonetheless, I imagine CEG’s monetary breakdown factors in direction of a powerful and steady enterprise mannequin, each from an intrinsic and relative standpoint. Moreover, perceive that the 2022 spin off created additional points in valuing the corporate. Taking all this into consideration, I opted to make broader stroke assumptions reasonably than taking aside the nuts and bolts. Beneath you may see my multiple-based evaluation and intrinsic DCF evaluation.

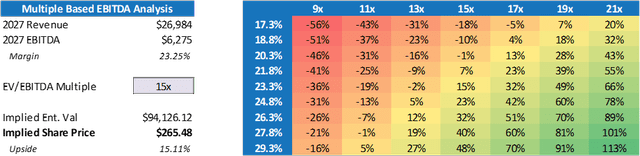

A number of-Based mostly Valuation

For my multiple-based evaluation, I made a decision to have a look at EV/EBITDA (Non-GAAP). My income of $26,984 million is above consensus by 244 million (+0.9%), and my EBITDA of $6,275 million is above consensus by $1,026 million (+19.5%). This primarily implies the next EBITDA margin in reference to decrease prices from onsite knowledge middle offers. Moreover, my 15x a number of is barely decrease than at the moment’s valuation of 16.47x. You too can illustrate this evaluation with an EBITDA extra consistent with 2027 steering and a a number of inside the 18x vary. Each these situations stay possible and indicate related upside, however depend on totally different expectation shifts.

Writer’s Calculations

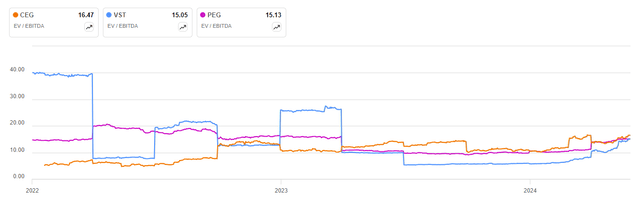

Wanting from a unique angle, I examined CEG in opposition to Vistra Corp. (VST) and Public Service Group (PEG). This is because of related knowledge middle deal potential for each corporations. Crucial differentiation I noticed was in capital construction and debt administration. CEG’s debt-to-equity ratio is 86%, in comparison with VST’s 226% and PEG’s 137%. Then CEG’s protection ratio is 5.33, in comparison with VST’s 2.51 and PEG’s 3.24. Whereas Constellation continues to be establishing its margin base, it stays priced in-line with these two comps. Beneath, you may see the historic EV/EBITDA of all three corporations, which appear to cluster across the 15x-17x vary.

Searching for Alpha

Intrinsic Valuation

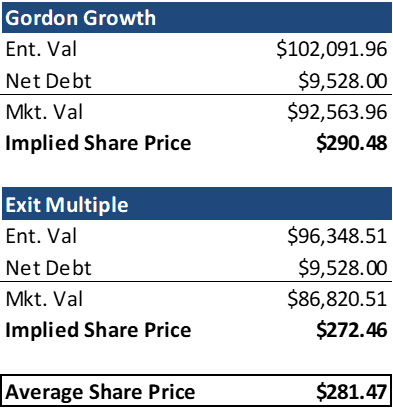

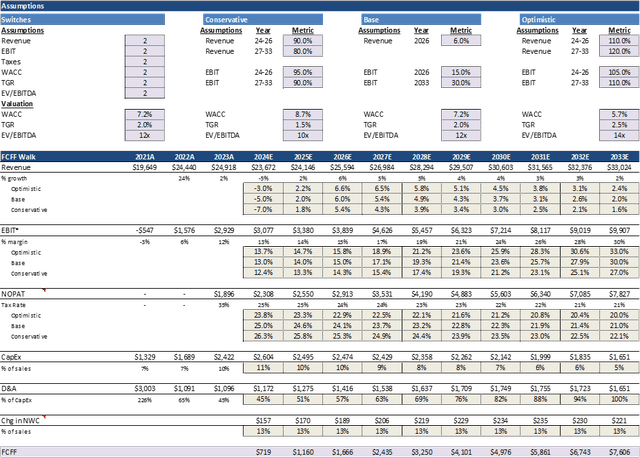

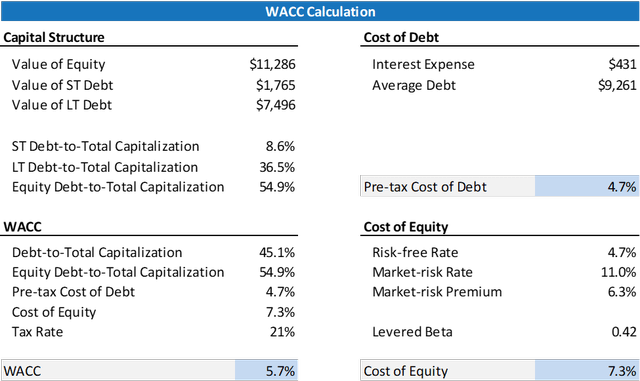

Transferring to the intrinsic valuation, the skew stays broad for potential outcomes. Beneath you may see my base case which suggests a share worth of $281 with a 22% upside. This assumes a 7.2% WACC, 2% TGR, and a 12x EBITDA exit a number of. Then again, my conservative case assumes a $160 share worth (-31%), and my optimistic case assumes a $523 share worth (+127%). The optimistic case is completely pushed by WACC, which really got here out to five.7% when utilizing the theoretical calculation. To fight this, I merely added 1.5% for my base case and saved the 5.7% within the optimistic situation.

Writer’s Calculations

Beneath, you may see the complete structure of my DCF mannequin and WACC calculation, with key assumptions on the high. The principle driver to focus on contains an adjusted EBIT margin growth of 17% (13% to 30%) by 2033. This means that premium pricing will develop at a a lot quicker price than prices, whereas additionally seeing operational enhancements. Moreover, my exit a number of, TGR, and income development additionally stay fairly conservative in opposition to present expectations.

Writer’s Calculations

Writer’s Calculations

Catalysts

Authorities help will proceed, with PTCs and ZECs helping the agency financially. This may increasingly even be not directly supported by the push for US management in synthetic intelligence. Whereas nothing foundational has occurred, CEG did enter right into a deal late final June with Microsoft to produce knowledge facilities with nuclear vitality. Any bulletins of a full-fledged knowledge middle and nuclear PPA deal may result in even additional inventory worth appreciation.

Progress initiatives additionally proceed with CEG repeatedly investing in nuclear uprates, license renewals, and the potential restart of previous vegetation. These efforts spotlight administration’s confidence within the area, with the potential Three Mile Island reopening serving as an important catalyst for investor sentiment. Then Constellation’s high-capacity issue and technological upgrades even additional solidify these initiatives

Lastly, the demand for carbon-free, 24/7 vitality is at an all-time excessive and can solely proceed to develop. I believe over the following 5 to 10 years, an important shift in direction of nuclear vitality will happen. Present targets, which embrace the US reaching net-zero emissions by 2050, stay unrealistic. The one present-day provider of this explicit kind of vitality is nuclear.

Dangers

The clear danger behind investing in Constellation Power is the current surge in inventory worth. That is the recipe of AI hype and widespread knowledge middle alternative. There may be an apparent argument for the agency being overpriced, particularly when in comparison with different electrical utility corporations. Due to this, in case your danger urge for food skews conservatively, I like to recommend ready for decrease entry factors.

Furthermore, a lot of my evaluation stays speculative and assumes a sturdy shift in direction of nuclear energy provide over the following decade. This implies persistence is the important thing, and the corporate will almost certainly face totally different ranges of cyclicality. Additionally, I could have missed sure arguments inspecting the regulatory results of CEG’s financials or different operational elements.

Lastly, there’s a likelihood knowledge middle offers do not materialize or stay within the early phases for an prolonged time frame. This might result in a big drop in market worth, because the premium worth thesis can be pushed out additional. Then, from a valuation perspective, the corporate famous a change from specializing in Non-GAAP EBITDA to Non-GAAP EPS. My evaluation didn’t embrace an in-depth have a look at EPS development, dividends, or the P/E ratio. Total, CEG stays dangerous, and a big portion of my thesis entails hypothesis of provide and demand shifts.

Conclusion

Regardless of Constellation’s inventory worth run, I nonetheless imagine there may be vital room for development. Because the US chief in nuclear capability, CEG greater than doubles the following closest competitor. Its strategic positioning in deregulated markets permits for aggressive pricing, which is essential as corporations demand 24/7 clear vitality choices. Moreover, in depth authorities help, a number one nuclear capability issue, and the potential reopening of Three Mile Island current sturdy catalysts for even additional upside. Whereas I like to recommend a purchase for CEG, I encourage traders to proceed with warning. For extra conservative people, I recommend both dollar-cost averaging or ready for a possible pull again. Both means, it must be clear that Constellation Power is a unbelievable long-term funding.