Canada has emerged as one of many world’s fastest-growing digital infrastructure hubs, with its knowledge heart market increasing at unprecedented pace. In keeping with a current DCByte report, the nation’s complete IT capability now exceeds 10 GW throughout operational, under-construction, dedicated, and early-stage tasks – a dramatic pivot from regular progress to exponential growth.

What makes this progress notably placing is that greater than three-quarters of Canada’s capability stays within the early-stage and dedicated pipeline, signaling sustained growth momentum that positions the nation as a formidable international chief for years to return.

Regional Hubs Drive Funding Momentum

The DCByte report identifies Toronto, Montreal, and Alberta as Canada’s dominant knowledge heart hubs, collectively accounting for 93% of the nation’s complete IT load. Among the many leaders on this growth is Alberta’s Marvel Valley challenge, a landmark 5.6-GW initiative backed by O’Leary Ventures. The challenge is anticipated to catalyze additional regional progress and growth.

Emma Reese, analysis analyst for Canada and the Northwest US at DCByte, acknowledged that Marvel Valley may have a major impression on the ability provide. The location has a complete energy capability of seven GW and a important IT load of 5.6 GW. “Finding the challenge in Alberta highlights rising investor curiosity in large-scale Canadian builds,” Reese famous. Alberta’s combine of presidency incentives, plentiful land and energy sources, and Marvel Valley’s GPU-ready infrastructure positions the province as a primary vacation spot for high-density tasks, attracting keen traders.

A rendering of the Marvel Valley knowledge heart park in Alberta. (Supply: O’Leary Ventures)

This personal sector momentum is being amplified by substantial authorities funding. The 2024 federal funds allotted $2.4 billion for brand new computing infrastructure and security analysis. Moreover, on the finish of 2024, the federal government dedicated C$240 million (US$169 million) to help Toronto-based AI startup Cohere in creating AI knowledge facilities. Cohere’s Bell AI Material challenge is ready to ship 500 MW of capability upon completion.

The funding surge spans a number of areas and varied financing fashions. For instance, New York-based property developer Associated Corporations, higher recognized for glitzy Manhattan high-rises, is planning its first North American knowledge heart challenge in Ontario. In the meantime, modern financing approaches are rising, with Canadian colocation supplier eStruxture securing C$750 million in asset-backed securities funding as half of a bigger C$1.35 billion package deal.

Nonetheless, the size of the alternatives comes with execution challenges. In keeping with Reese, whereas billions of {dollars} are flowing into Canadian AI tasks, “many of those investments are going in direction of tasks which might be nonetheless in early growth levels, with established markets like Toronto and Montreal dealing with energy and land shortages and new markets navigating distribution challenges.”

Pace and regulatory certainty have grow to be important differentiators. Jennifer Cahil, affiliate vp and campus infrastructure integration lead at Black & Veatch, emphasised the urgency of the AI knowledge heart race, which is now measured in months reasonably than years. “Builders are looking for pace and certainty by way of dependable, resilient and, if doable, diminished carbon energy, predictable rules, and fast-track growth,” she defined.

The urgency performs to Canadas elementary strengths. Cahil confused Canada’s aggressive edge in providing a secure funding atmosphere. Provinces that prioritize infrastructure growth alignment, allowing effectivity, and utility collaboration are capturing curiosity. “The bottom line is the reliability of the event runway,” she mentioned. “If Canada can preserve this stability, it should proceed to attract international AI funding.”

Energy and Sustainability Drive Progress

Stuart Cox, JLL’s knowledge heart market skilled in Canada, mentioned that whereas Canada’s multi-billion-dollar AI commitments show robust demand, the precise driver of progress is energy. “Knowledge facilities comply with a easy rule: In the event you can energy it, they’ll come,” he mentioned. Hyperscalers and AI platforms prioritize websites that may ship giant, contiguous megawatts rapidly, with redundant fiber and clear allowing processes in place.

Cox highlighted Québec as a mannequin for achievement on account of its comparatively clear and inexpensive hydroelectric energy, environment friendly siting processes, and operators able to delivering 100-200+ MW phases. “It’s progress – however nonetheless small subsequent to U.S. giga-sites,” he famous. Scaling up clear energy sources, comparable to nuclear expansions and pure fuel vegetation, together with sooner grid paths, streamlined transmission and interconnect processes, and pre-entitled mega-sites geared up with cooling water, drainage, and dual-diverse long-haul fiber connections to hubs like Toronto, Montréal, and Calgary, may remodel Canada’s knowledge heart panorama.

“AI-innovation {dollars} are complementary and can assist fill capability as soon as land, energy, and fiber are secured,” Cox added. “Canada turns into a top-tier AI-infrastructure host when it may repeatedly ship gigawatt-scale, low-carbon energy on predictable timelines – all the things else follows.”

Canada’s Sustainability Edge

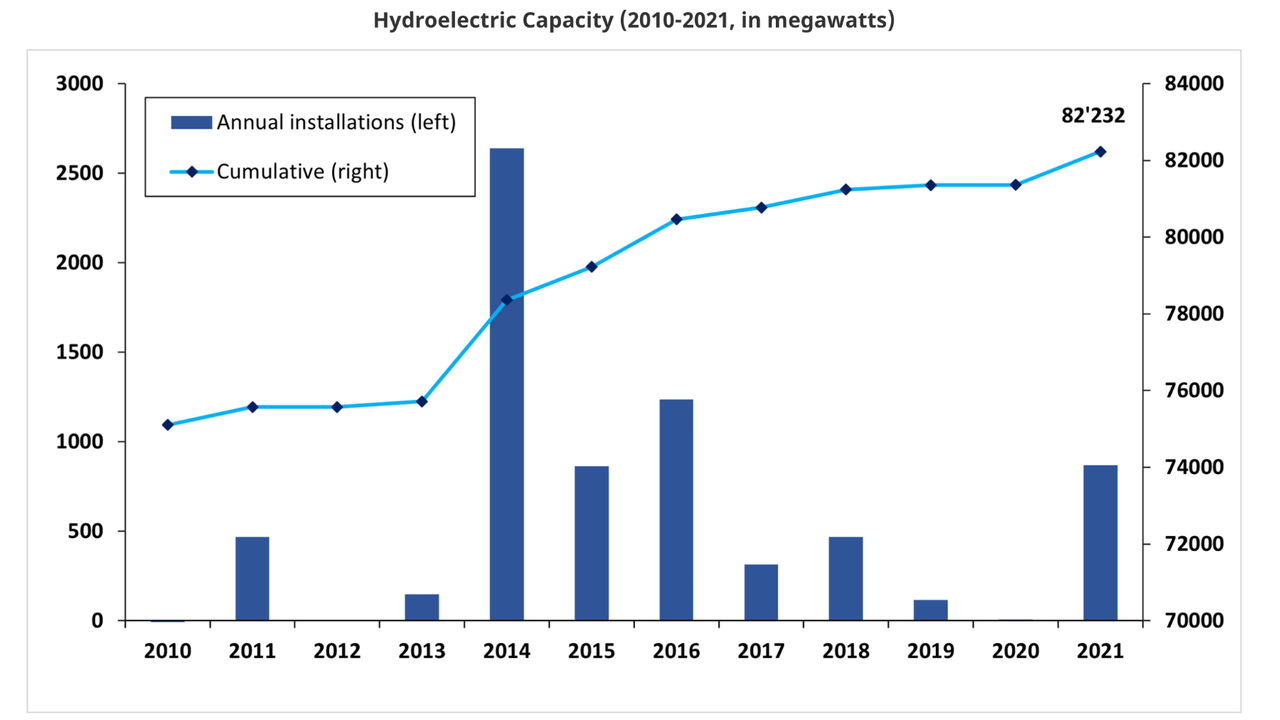

Sustainability stays a defining aggressive benefit for Canada’s knowledge heart market. With roughly 60% of the nation’s electrical energy derived from hydropower, operators profit from a cleaner and extra cost-efficient vitality provide. This renewable vitality edge has made Canada an interesting vacation spot for international hyperscalers and AI infrastructure traders looking for to steadiness efficiency with environmental objectives.

Reese famous that Canada’s distinctive energy grid helps hyperscalers meet ESG and carbon reporting necessities whereas enabling innovation in cooling and density designs. “Nonetheless, probably the most vital sustainability profit comes from Canada’s local weather itself,” she added. “Cool environments allow operators to scale back cooling prices and improve effectivity.”

Canada’s hydroelectric capability. (Supply: natural-resources.canada.ca)

Established Leaders vs. Rising Challengers

On the aggressive entrance, established gamers comparable to Vantage Knowledge Facilities, Cologix, and Compass at present lead Canada’s dwell capability footprint. Nonetheless, the DCByte report notes that rising entrants, comparable to O’Leary Ventures and Beacon, are reshaping the market with large-scale builds optimized for AI and GPU workloads. These new deployments are anticipated to shift the aggressive panorama by 2027, as next-generation, high-density services come on-line.

Toronto and Montreal, Canada’s oldest knowledge heart hubs, will proceed to dominate the market regardless of challenges with energy and land availability, Reese mentioned. “You will need to observe that Alberta has a head begin within the AI race that it’s more likely to maintain on to with quite a few early-stage tasks which might be nonetheless buying energy, allowing, or land,” she added. Vancouver additionally exhibits potential for progress as a secondary market, serving as an important connection level to Asia, Australia, and Polynesian international locations.

Vantage Knowledge Facilities’ Montreal QC1 Knowledge Heart (Supply: Vantage Knowledge Facilities)

Northern Publicity: Alternatives and Challenges in Canada’s North

Builders are actively exploring Canada’s northern areas as viable websites for hyperscale and AI-focused knowledge facilities, in keeping with Cahil. “The cooler local weather in northern provinces like Ontario, Quebec, and components of Atlantic Canada supplies a pure cooling impact, considerably decreasing the vitality required for thermal administration in high-density knowledge facilities,” she mentioned. Canada’s huge freshwater reserves additionally help superior cooling applied sciences, comparable to liquid immersion and closed-loop techniques, enhancing sustainability and value effectivity for hyperscale and AI workloads.

Regardless of these benefits, Reese famous that northern Canada faces vital challenges, together with logistical, connectivity, and land entry points, which hinder large-scale growth. “Presently, the main focus appears to stay on Vancouver, Montreal, and Alberta,” she mentioned. Entry to northern areas is usually restricted, notably in Nunavut, which depends closely on air journey and has a much less strong web infrastructure in comparison with Yukon and the Northwest Territories.

Reese emphasised the significance of collaboration with Indigenous communities. “The first impediment for these concerned with increasing to those areas is the prevalence of tribal lands, requiring shut collaboration with First Nations, Inuit, and Métis communities, and adherence to their insurance policies for any growth tasks,” she defined.

Cox identified that whereas operators are exploring northern Canada, choices for knowledge heart places are primarily pushed by energy and fiber availability reasonably than local weather. AI knowledge facilities are more and more adopting liquid cooling applied sciences, comparable to rear-door warmth exchangers and direct-to-chip techniques, which cut back reliance on ambient temperatures. “Plant effectivity, water and heat-rejection techniques, and electrical density matter far more than exterior temperature,” Cox mentioned.

Connectivity stays a major constraint for northern areas. Hyperscale operators require dual-diverse, long-haul fiber hyperlinks to main peering hubs, however many northern corridors are single-threaded or have restricted capability. “These lengthy paths can add 10 to twenty milliseconds of latency to southern hubs,” Cox defined. “That’s effective for AI coaching or chilly knowledge storage, however painful for user-facing inference workloads.”

Energy availability is the highest hurdle. Many northern websites require new transmission traces or on-site energy era, comparable to fuel generators, small modular reactors, or hydroelectric upgrades, which improve prices, complexity, and development timelines. Logistics additional complicate growth, with challenges comparable to permafrost, seasonal roads, brief development home windows, and restricted native labor, all of which inflate prices and sluggish progress. Moreover, repairs to components and fiber in these distant areas take longer, rising service-level dangers.

Cox concluded that northern knowledge heart growth will stay restricted till a hall can ship agency, clear energy, numerous fiber routes, preserved land and water, and a serious anchor tenant keen to just accept latency trade-offs.

“Till these situations exist, northern builds will keep area of interest,” Cox mentioned. “The massive waves of capability proceed to land the place energy and fiber are already bankable.”