BTIG has raised its value goal for crypto miner Core Scientific Inc (NASDAQ:) to $15 from $10, citing new knowledge middle contracts and progress potential within the mining sector.

BTIG’s BTC mining basket, comprising 14 firms, has an combination hash price of about 138 EH, which represents 23% of the worldwide hash price. The hash price is predicted to develop to 153 EH by 2025, pushed by new rigs that enhance fleet effectivity.

Bitcoin’s value at the moment hovers round $62,000, up 45% year-to-date, with miners’ margins benefiting from increased costs. The worldwide hash price averaged 582 EH in June, down from 600 EH in Could however up 57% from final yr. Community issue has steadily elevated, up 60% over the previous yr and 16% year-to-date.

In the meantime, Core Scientific introduced a 200MW high-performance computing (HPC) contract with CoreWeave, adopted by a further 70MW of information middle contracts. This information has pushed Core Scientific’s top off by almost 90% in latest weeks. BTIG highlighted that the shift to fixed-price multi-year contracts allowed some miners to decouple from Bitcoin costs, which have dropped about 11% since early June.

“The pivot to fixed-price multi-year contracts has seen CORZ and a few miners decouple from the BTC value, with Terawulf up over 100% and Iris up round 70% over this era,” BTIG said.

The race for energy entry has intensified amongst publicly listed BTC miners because of rising demand from knowledge middle firms. “For each 100MW of energy transformed or powered-up for HPC, that is 5-6 EH much less for the worldwide hash,” BTIG famous.

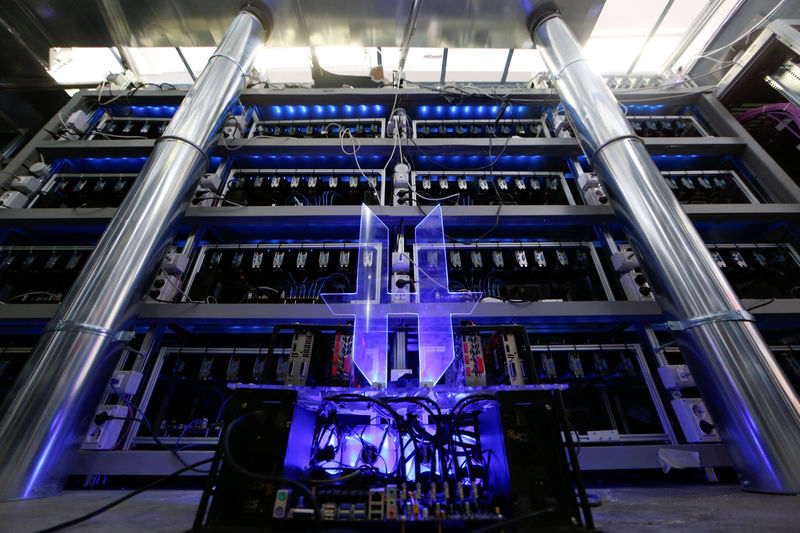

Throughout website visits to Riot’s Corsicana facility, which targets round 1GW, and Core Scientific’s Denton facility, BTIG noticed that the industrialization of BTC mining has arrived. Riot’s Corsicana facility is predicted to succeed in 31 EH by the tip of this yr and 41 EH by 2025.

The report make clear Bitdeer’s investor discussions, which revealed a deal with designing mining rigs and changing present amenities for HPC computing. “The low-hanging fruit is its Washington facility, close to a Microsoft (NASDAQ:) knowledge middle, with potential conversions in Ohio and Norway,” BTIG reported.

BTIG estimates the worth of Core Scientific’s 286MW of fastened HPC contracts at $9-$10 per share, assuming a 15x EBITDA a number of. “Information middle REITs are buying and selling at about 20x EBITDA on 2025,” BTIG added. With a goal of 500MW for HPC by 2028, BTIG expects a further $5 per share worth, justifying the brand new value goal of $15.