Synthetic intelligence (AI) is at present the most important tailwind within the know-how sector. Generative AI has numerous functions, and mega-cap tech giants are main innovation throughout the trade.

One of many delicate development alternatives in AI is knowledge facilities. In actual fact, Statista estimates that community infrastructure, storage and server options might be a $439 billion alternative by 2028.

Certainly, Nvidia And Superior micro gadgets have been main beneficiaries of knowledge middle community providers thus far. Nonetheless, sensible buyers know that along with the plain winners, there are additionally peripheral alternatives.

One AI knowledge middle inventory I’ve been maintaining a tally of is Oracle (NYSE: ORCL). Let’s check out why Oracle may very well be a profitable alternative for long-term buyers as the information middle growth continues to unfold.

AI knowledge facilities are on the rise and…

In addition to Nvidia and AMD, quite a few different know-how firms are making waves within the area of knowledge facilities.

Vertiv is a novel alternative that has witnessed great development because of the rising demand for knowledge middle providers. Plus, the corporate’s shut ties with Nvidia definitely don’t harm.

Additional, Amazon not too long ago introduced an $11 billion funding to construct out extra knowledge middle infrastructure. This isn’t fully shocking, as Amazon is a frontrunner in cloud computing platforms, and the corporate is creating its personal semiconductor coaching and inference chips.

…Oracle is quietly rising as a significant drive

In March, Oracle introduced monetary outcomes for the third quarter of fiscal 2024 (ending February 29). At first look, the corporate’s 7% year-over-year income development could seem mundane.

Nonetheless, Oracle reported quite a few different key efficiency indicators past the normal monetary statements. Maybe a very powerful of those metrics was residual efficiency obligations (RPO). This can be a essential operational metric as a result of it measures an organization’s backlog and offers buyers a glimpse of future development.

On the finish of Oracle’s fiscal third quarter, RPO grew 29% 12 months over 12 months to $80 billion – a report for the corporate.

One of many causes for such a excessive backlog? Knowledge facilities. In the course of the earnings name, Oracle Chairman Larry Ellison acknowledged that the corporate is “constructing knowledge facilities at report ranges.”

He’s not exaggerating. Simply this week, Bloomberg reported that one among Elon Musk’s startups, xAI, is reportedly in talks with Oracle for a $10 billion deal to lease cloud servers.

Are Oracle shares a purchase?

The potential deal between Oracle and xAI doesn’t make the inventory a purchase. The deal might fall by and there’s no assure that xAI will use Oracle for its cloud options.

That mentioned, I’m cautiously optimistic that the deal will get finished. Oracle already works with xAI because it pertains to different AI providers. Moreover, Larry Ellison and Elon Musk have a much-discussed optimistic relationship – a lot in order that Ellison was on the Tesla‘s Board of Administrators.

The larger concept right here is that firms depend on extra than simply legacy hyperscalers Alphabet, Microsoft, Amazon and Nvidia for his or her AI cloud wants. Whether or not or not Oracle closes the cope with xAI, I view the negotiations as an vital supply of affirmation that there might be many winners within the AI knowledge middle area exterior of massive tech.

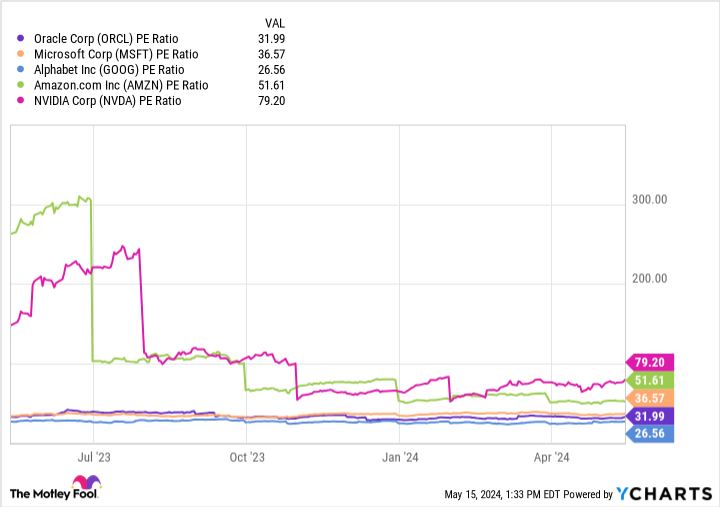

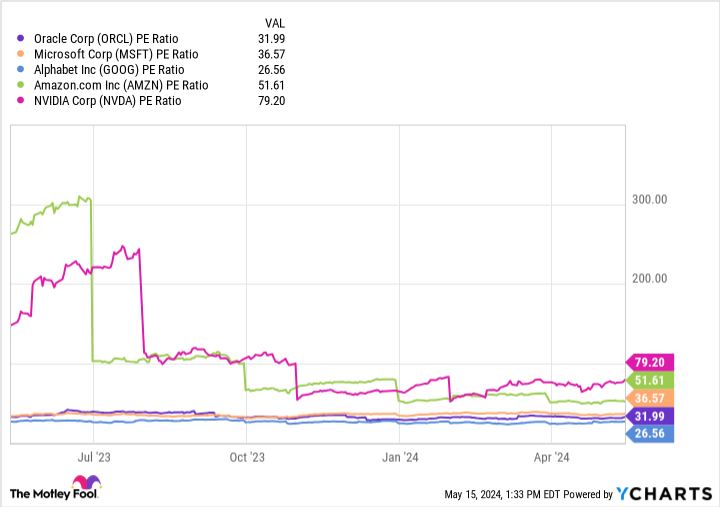

Whereas Oracle’s price-to-earnings (P/E) ratio of 31.9 isn’t precisely grime low-cost, it’s properly beneath lots of its friends.

I feel it is a nice alternative to construct a place in Oracle inventory. As demand for AI cloud storage options continues to rise, Oracle ought to see an inflow of enterprise from each new and present prospects.

The secular traits driving AI symbolize a brand new development story for Oracle, and I see this as an excellent time to choose up some inventory. It seems to be like the perfect days are forward for Oracle, and I’m optimistic that additional features are in retailer for long-term shareholders.

Ought to You Make investments $1,000 in Oracle Now?

Contemplate the next earlier than shopping for shares in Oracle:

The Motley Idiot inventory advisor The analyst staff has simply recognized what they assume is the 10 finest shares for buyers to purchase now… and Oracle wasn’t one among them. The ten shares that survived the lower might ship monster returns within the coming years.

Take into consideration when Nvidia created this checklist on April 15, 2005… if you happen to had $1,000 invested on the time of our suggestion, you’ll have $566,624!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with portfolio constructing steerage, common analyst updates, and two new inventory picks per 30 days. The Inventory Advisor is on responsibility greater than quadrupled the return of the S&P 500 since 2002*.

View the ten shares »

*Inventory Advisor returns Could 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions at Alphabet, Amazon, Microsoft, Nvidia and Tesla. The Motley Idiot holds positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Microsoft, Nvidia, Oracle, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls to Microsoft and brief January 2026 $405 calls to Microsoft. The Motley Idiot has a disclosure coverage.

A One-Time Funding Alternative: 1 Knowledge Heart Inventory That May Go Parabolic (Trace: Not Nvidia) was initially printed by The Motley Idiot