The growth in synthetic intelligence expertise is anticipated to ripple past semiconductor and software program shares. The information facilities that prepare and host AI applications require electrical energy, and plenty of it.

Consequently, knowledge heart growth means a brand new supply of demand development for utilities. Morningstar analysts don’t consider this factor has been factored into the costs of utility shares but. This comes whereas electrical energy demand can also be being lifted by development in electrical autos. “We anticipate electrical energy demand development to prime market expectations, requiring substantial power infrastructure funding and boosting utilities’ earnings development,” says Morningstar strategist Travis Miller.

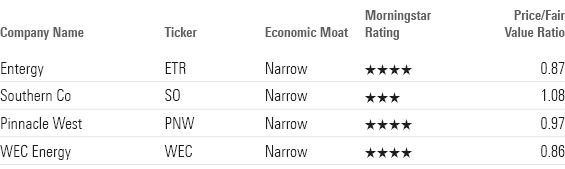

The utilities sector was 5% undervalued as of Could 1, in accordance with Morningstar analysts, with many firms predicted to revenue from the rise in electrical energy demand. Travis and fellow Morningstar strategist Andrew Bischof see 4 shares as best-positioned to learn from knowledge heart development:

- Entergy ETR

- Southern Firm SO

- Pinnacle West Capital PNW

- WEC Vitality Group WEC

Of the three, Entergy, Pinnacle, and WEC are thought-about undervalued by Morningstar, whereas Southern is deemed pretty valued.

Information Heart Electrical energy Demand Seen Booming

Information facilities are devoted areas for housing pc programs, together with knowledge processing {hardware}. To maintain up with the growth, utilities will face the challenges of serving peak summer season and winter demand whereas aiming to make use of clear power, which requires appreciable investments in power storage and grid updates. “One giant knowledge heart might require billions of {dollars} of utility funding,” Miller explains.

Taking a look at demand development, the bottom case from Morningstar analysts—which considers that electrical energy demand will proceed to lean extra towards electrical autos over knowledge facilities—is a 1.4% annualized enhance via 2032, the quickest development in 20 years. That’s a cumulative 46% enhance in knowledge heart demand by that 12 months. Morningstar analysts provide a bull case whereby knowledge heart development accelerates demand by 131% via 2032. In that case, knowledge heart demand will surpass EV demand.

“The outlook for knowledge heart electrical energy demand is trending towards our bull case situation,” Miller says. “If anticipated knowledge heart growth materializes, we are going to take into account elevating our honest worth estimates for some US electrical distribution utilities.”

Which Utilities Shares Are Finest Poised to Profit from Information Heart Demand?

Location performs a key position by which knowledge heart firms have the most effective likelihood of succeeding. Decrease energy costs are key, given the electrical energy necessities of information facilities. This offers firms that function out of the Southeast and among the Midwest a aggressive benefit. Moreover, Bischof says traders ought to search for “utilities that function in constructive regulatory jurisdictions with key stakeholder assist in excessive financial growth areas.”

Right here’s a more in-depth have a look at Morningstar’s picks for utility shares anticipated to learn from knowledge heart development.

Entergy

“Entergy’s rising, energy-hungry buyer base and constructive charge regulation within the US Southeast give the corporate an extended runway of earnings and dividend development potential.

“We anticipate Entergy to speculate almost $7 billion yearly on common for the following 5 years to improve its electrical grid and broaden its clear power portfolio. Industrial clients, which characterize about half of Entergy’s buyer base, usually assist these investments in reliability and energy era with decrease carbon emissions.

“We forecast Entergy’s deliberate development investments and buyer development will result in annual earnings development towards the highest half of administration’s 6%-8% goal. Constructive regulatory outcomes might push administration’s $20 billion capital funding plan in 2024-26 larger, boosting earnings development to close 8% via the last decade.”

Learn extra of Travis Miller’s analyst notes right here.

Southern Firm

“Southern is within the means of a dramatic clear power transformation. Its $43 billion capital funding plan in the course of the subsequent 5 years will cut back greenhouse gasoline emissions, broaden renewable power, strengthen the gasoline system, and assist the Southeast area’s fast-growing power demand.

“In 2000, nearly 80% of the electrical energy Southern offered was generated utilizing coal. That share is now under 20% and falling. The corporate is aiming to retire all however eight coal vegetation by 2028 and attain net-zero carbon emissions from energy era by 2050. Nuclear, pure gasoline, and renewable power are all rising their share of era.

“With a renewed concentrate on smaller tasks, we predict Southern can produce regular 6% earnings development. Dividend development has trailed earnings development in recent times due to Southern’s giant investments, however we anticipate dividend development to speed up and match earnings development beginning in 2024 when Vogtle is completed.”

Learn extra of Travis Miller’s analyst notes right here.

Pinnacle West Capital

“Till 2021, Pinnacle West had been incomes strong returns and rewarding shareholders with dividend will increase as buyer and power utilization development in Arizona outpaced most different utilities. However regulatory setbacks have made it troublesome for Pinnacle West to show these favorable fundamentals into earnings and dividend development.

“Arizona regulators’ determination to chop Pinnacle West’s allowed return on fairness to eight.7% from 10% contributed to a $200 million charge lower in 2022. It appeared earnings wouldn’t attain 2021 ranges once more till 2025. However Pinnacle West reversed a few of that charge lower with a profitable attraction, and a brand new set of regulators accredited a $253 million annualized charge enhance in March 2024.”

Learn extra of Travis Miller’s analyst notes right here.

WEC Vitality Group

“WEC Vitality Group is the most important Midwest utility, with roughly $29 billion of charge base, and it derives most of its earnings from regulated operations. Practically 75% of earnings come from areas with constructive Wisconsin and Federal Vitality Regulatory Fee laws. Its business renewable power enterprise accounts for the rest of its earnings.

“We anticipate the corporate to speculate $23.7 billion of capital via 2028, which incorporates its funding in American Transmission. This funding plan helps our forecast that the corporate will obtain the excessive finish of administration’s slim 6.5%-7% annual earnings development goal.”

Learn extra of Andrew Bischof’s analyst notes right here.