As synthetic intelligence (AI) is quickly put in in big-tech information facilities, the funding group is beginning to fear a few new set of associated points: elevated vitality consumption. The semiconductor techniques used to energy AI, comparable to these of Nvidia — eat massive quantities of vitality, a lot in order that expectations for international vitality demand are rising quickly.

Nvidia isn’t nervous. It has an ecosystem of technical companions working laborious to resolve vitality supply and different associated information heart points. A type of companions that obtained a reputation change from CEO Jensen Huang earlier in 2024 is Vertiv Holdings (NYSE: VRT). The inventory could possibly be a purchase, if the worth was proper.

Vertiv holds a key place in technical information facilities

Till just lately, Vertiv was a fairly boring industrial vitality expertise firm. It has been break up from Emerson Electrical and bought to non-public fairness in 2016. In 2020, the identify was modified to Vertiv and the corporate was taken public by way of a particular objective acquisition firm (SPAC).

After that, the shares didn’t do a lot to write down dwelling about — at the very least not till 2023, when buyers obtained wind of Vertiv’s potential in information heart functions. After which in March 2024, throughout Nvidia’s annual weeklong GPU expertise convention, it was introduced that Vertiv was becoming a member of the Nvidia Accomplice Community. That relationship actually electrified the inventory value.

Talking of electrification, Vertiv designs and manufactures energy supply and administration techniques for information heart servers (the computing models that sit in pull-out drawers in information heart racks).

As with all electrical techniques, extra energy consumption means extra warmth, a dangerous facet impact of highly effective new AI servers. Vertiv additionally designs the cooling techniques. The addition of Nvidia as one in every of Nvidia’s key advisors in energy and cooling techniques naturally creates excessive optimism amongst buyers, given the pace at which Nvidia is rising.

Vertiv itself appears more than pleased to tout its integration into Nvidia’s ecosystem. With AI revolutionizing the best way information facilities are managed, the corporate believes it has a brand new development tailwind. Administration mentioned the backlog of apparatus and repair orders elevated 15% to $6.3 billion in simply three months from the top of 2023 to the top of the primary quarter of 2024.

A priceless chain associate, however how priceless?

Vertiv’s inventory progress has been spectacular to look at, however I worry its valuation now exceeds present actuality. With a market cap of over $36 billion after the latest run-up, the inventory is valued at almost 40 instances anticipated 2024 earnings per share (EPS).

To be clear, this isn’t probably the most egregious valuation being debated within the AI ​​funding frenzy. Nevertheless, Vertiv expects natural income development (excluding acquisitions and divestitures) to extend by roughly 12% this 12 months.

The expansion ensuing from the AI ​​increase in information facilities seems to be already priced in, until administration critically underestimates precise income. Maybe a few of that $6.3 billion backlog will flip into income in the end.

Proper now, Vertiv is certainly an attention-grabbing firm that could possibly be a winner of the AI ​​race in the long term. It appears to have carved out a place for itself within the information heart provide chain, and particularly for AI powered by Nvidia. Maybe Vertiv’s development story will last more than simply the latest hype.

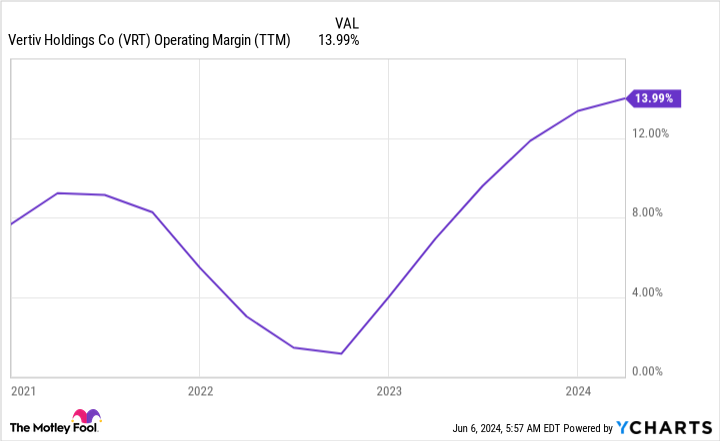

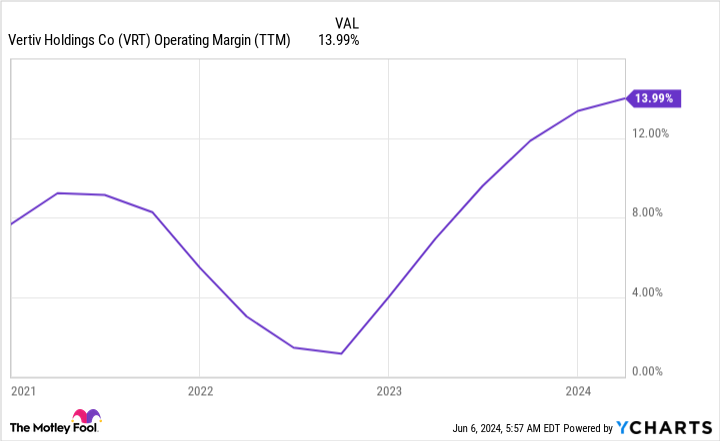

However for an tools engineer whose destiny as a premium-priced inventory largely depends upon Nvidia’s innovation, the present valuation is a bit excessive for my style. Not solely will Vertiv must develop, however its revenue margins (working margin of 14% during the last twelve months) will even must develop to justify the rise in share costs.

For now, Vertiv is on my watchlist, however that’s it. If share costs cool off a bit, this could possibly be value revisiting.

Ought to You Make investments $1,000 in Vertiv Now?

Earlier than buying shares in Vertiv, take into account the next:

The Motley Idiot inventory advisor The analyst crew has simply recognized what they assume is the 10 greatest shares for buyers to purchase now… and Vertiv wasn’t one in every of them. The ten shares that survived the minimize might ship monster returns within the coming years.

Take into consideration when Nvidia made this record on April 15, 2005… in case you had $1,000 invested on the time of our advice, you’d have $740,688!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with portfolio constructing steerage, common analyst updates, and two new inventory picks monthly. The Inventory Advisor is on obligation greater than quadrupled the return of the S&P 500 since 2002*.

View the ten shares »

*Inventory Advisor returns June 3, 2024

Nicholas Rossolillo holds positions at Nvidia. The Motley Idiot holds positions in and recommends Emerson Electrical and Nvidia. The Motley Idiot has a disclosure coverage.

1 Sizzling Information Heart Shares to Purchase — If It Ever Cools Off was initially printed by The Motley Idiot